Back in 1990, I was just out of college and fairly broke. I was living in a basement apartment with two roommates. It was a dump.

At the end of each month, my meager paycheck was basically gone. I decided I needed to learn about the stock market to make some money.

I read everything I could get my hands on. I spent many Saturdays at the New York Public Library absorbing as much as I could. (This was before the whole world was available on the internet.)

Soon I started trading and investing in stocks. And then my mind was blown when I discovered options.

Where I Started: Buying Puts and Calls to Speculate

Like most people, at first, I saw options as a shortcut to quick riches. Fortunately, I knew that I didn’t know what I didn’t know (ya know?), so I didn’t start trading options until I had a better understanding of them.

But even then, I was only buying puts and calls as speculations.

A put is a bet that a stock will go down. A call is a bet that it will rise. These option contracts allow you to control 100 shares of stock for pennies on the dollar for a specific amount of time.

For example, if you thought Bank of America (NYSE: BAC) was going higher in the short term, you could buy 100 shares for about $5,250. If the stock rose 10 points, you’d make about $1,000.

Or you could pay just $325 to buy a call that expires in March with a strike price of $52.50. That means if the stock is below $52.50 at expiration, your call expires worthless. If it’s above $52.50, the call will have value, depending on how high the stock rises and how much time is left until expiration.

If Bank of America shoots higher next week and is trading at $62.50, 10 points higher than it is today, your call would probably be worth around $1,100. So you’d be up $775 on a $325 bet.

If you’d bought the stock, you’d have risked $5,250 and made 19%. By buying the calls, you risked only $325 and made 238%.

You can see why people speculate with options. You risk less and can make a much higher percentage return.

My Big Revelation: Selling Options

But as I dug deeper into options, I learned something stunning: The real money in options is in selling them, not speculating with them. When a speculator buys a put or a call, someone has to sell them that option – and they get paid to do so.

Big financial institutions generally aren’t trying to hit home runs buying calls on Nvidia (Nasdaq: NVDA) and taking on that risk, but they’ll be happy to sell you some.

The more I understood this, the more I wanted to sell options to generate income right away.

Now that I’m older, while I still like to swing for the fences once in a while, my priority for my investments is generating income.

But over the past decade, I’ve increasingly used options to generate income with various strategies, including (but not limited to) covered calls and naked puts.

Covered Calls and Naked Puts 101

A covered call is when you own a stock and sell a call on it. In other words, someone is betting that the stock will go higher. When you sell the call to them, you get paid immediately. If the stock goes higher, you may have to sell your stock at the higher strike price, but you keep the money you got from selling the call.

If the stock pays a dividend, you can also continue to collect those dividends while you wait, which further boosts your return.

Then there are naked puts. When someone is worried about their stock going down – or speculating on a fall – they’ll buy a put. If you sell them a naked put, you are agreeing to buy that stock from them if it reaches the strike price. (In options trading, “naked” simply means you don’t own the stock already. “Covered,” as in covered calls, means you do own the underlying stock.)

Let’s say you’re interested in buying a stock, but only if you can get it at a 10% discount.

You could sell puts on that stock with a strike price 10% below the current price. That means if the stock drops by 10%, you will likely get to buy 100 shares of the stock at your target price. You also got paid for selling the put, which lowers your effective cost even more.

If the stock never drops to your target price, you still keep the money you received upfront when you sold the puts.

![]()

YOUR ACTION PLAN

I’ve come a long way since spending my weekends in the library. The time was well spent, as I now have a number of ways to put extra cash in my pocket. Had I sold options 35 years ago, I could have gotten out of that dumpy apartment a lot quicker – and eaten a lot less ramen.

Good investing,

Marc

FUN FACT FRIDAY

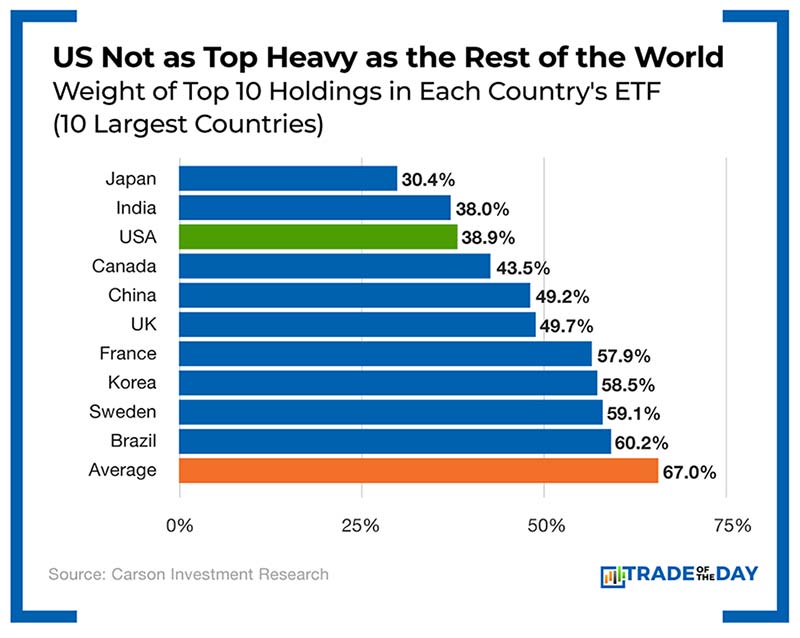

Not as bubbly as people think: With tech giant Nvidia recently crushing earnings again, there’s a lot of talk that we’re in an “AI bubble,” similar to the dot-com bubble back in the late 1990s. But the data shows the market isn’t as top heavy as we think.

Before the dot-com crash in 1999, the S&P 500 index gained more than 20%, but only 20% of stocks were above their moving average. This signaled a very top heavy market.

But as of today, more than half of the S&P 500 is in an uptrend in addition to AI. In fact, according to Carson Investment Research, the U.S. actually has one of the least concentrated stock markets among the 25 largest countries in the world. So while some tech stocks are crushing, most other sectors are also growing – albeit slower.