One of the biggest indicators of a winning insider buy is when insiders buy while the stock is getting hammered.

Take Exact Sciences (EXAS), for example.

Back in November 2024, the stock was nosediving.

Normally, this wouldn’t be anything to write home about.

Stocks go up and down for a variety of reasons.

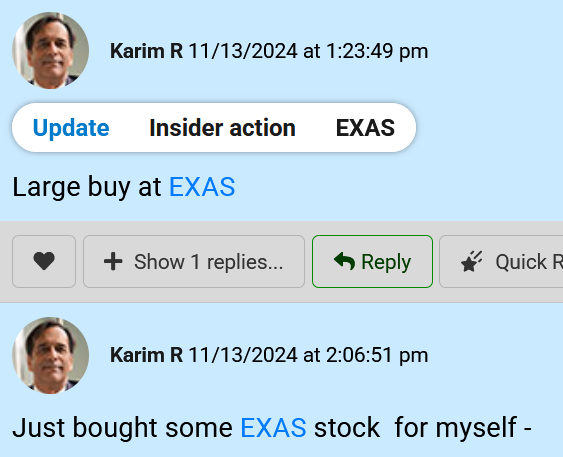

But as EXAS was tanking, something came across my scanner that caught my eye.

It was a large insider buy from a top-ranking EXAS officer.

The insider bought 19,500 shares – a big purchase

Remember, insiders only buy when the price of a stock is going up. In the case of EXAS, the stock was actually tanking ahead of the buy.

So I thought…

“Maybe this insider knows something I don’t.”

I alerted War Room Members and bought some shares myself.

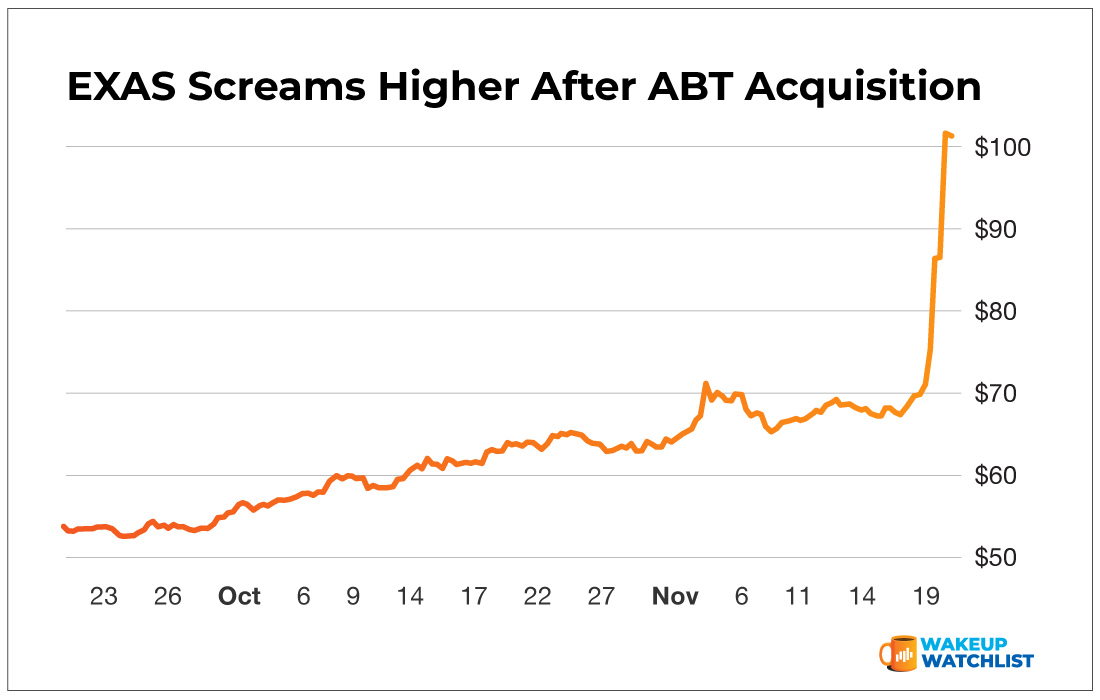

And while it took a little more than a year – this insider signal paid off handsomely yesterday morning.

Abbott announced it was acquiring EXAS for $105 per share.

Boom.

As you can see above, the stock screamed higher on the news – more than double than when I initially got in.

You think those EXAS insiders didn’t know about a possible acquisition from ABT? I’m sure they did.

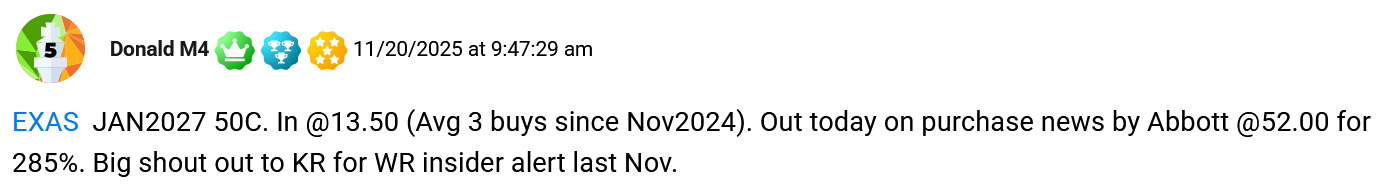

A War Room member who received the alert also bought shares and closed a 285% winner in 372 trading days.

This is the power of tracking insider buying. If an insider makes a big share purchase – especially when the stock is tanking – that’s a sign something could be in the works. In the case of EXAS, it was an acquisition that would happen more than 1 year later.

Insiders don’t buy by accident – they buy because they know. And that’s exactly why we follow them.

Action Plan: If you want to receive all of exact entries and exits for my insider plays in realtime, I invite you to join me in The War Room.

Right now we’re guaranteeing you’ll receive 252 winning trades in your first 12 months of membership.