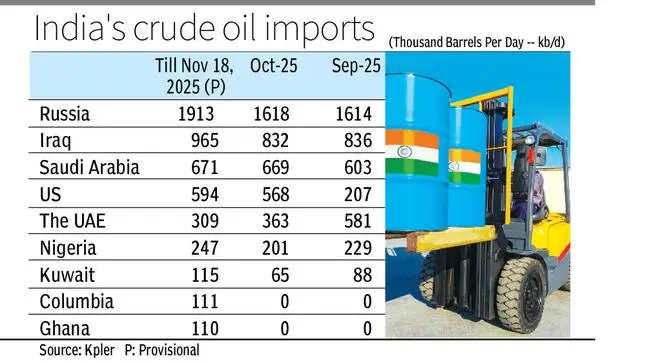

India’s crude imports from Russia are expected to remain very strong at 1.8–1.9 million barrels per day (mb/d) (as of November 18) as refiners continue to prioritise the most economical barrels. After November 21, the flows will decline noticeably in the near term

Even as India is lapping up Russian crude oil, lifting cargoes to a five-month high before the November 21 sanctions deadline by Washington, domestic refiners have started diversifying flows with traditional suppliers in the Middle East acting as anchor, coupled with barrels from the US and West Africa.

According to Kpler, before the US sanctions deadline, India’s crude imports from Russia are expected to remain very strong at 1.8–1.9 million barrels per day (mb/d) (as of November 18) as refiners continue to prioritise the most economical barrels. After November 21, the flows will decline noticeably in the near term.

US sancations

Based on the current understanding, the global real time and data analytics provider said no Indian refiner other than Nayara’s Vadinar refinery is likely to deal with Rosneft and Lukoil, the Russian oil giants sanctioned by the US.

However, analysts, refiners and traders indicate that a complete halt of cargoes from Moscow is unlikely, as crude oil itself is not sanctioned. Russia currently accounts for 35-38 per cent of India’s cumulative crude oil imports, which are expected to decline by more than half, with real impact to be visible from December 2025 onwards.

An official with a domestic refiner said: “Compliance mechanisms for the EU and US sanctions need to be seen. However, Russian oil will decline from next month. We expect Russians to have an alternative by March-April 2026.”

The US Energy Information Administration (EIA), in its November 2025 update to the short-term energy outlook, said: “Although the effect of sanctions on Russia’s oil exports is still unclear, we assess a slight drop in Russia’s crude oil output of about 0.1 million b/d in Q1 2026, as we believe the global oil market will adjust to the new sanctions.”

On Russian crude oil trade after November 21, Sumit Ritolia, Kpler’s Lead Research Analyst for Refining & Modeling, told businessline: “India does receive Russian crude from suppliers other than Rosneft and Lukoil, and those flows remain legal for now.”

The sanctions announced by the US target specific companies and their majority-owned subsidiaries. This means crude supplied by non-designated Russian entities, such as Surgutneftegaz, Gazprom Neft, or independent traders using non-sanctioned intermediaries, can still be legally purchased by Indian refiners, as long as no sanctioned entity, vessel, bank, or service provider is involved, he added.

Spare barrels

The US and EU sanctions on Russia have already pushed Indian refiners to look for spare barrels. They have turned to Iraq, Saudi Arabia, the UAE and Kuwait to compensate for the loss of medium sour grade (Urals) from Russia.

Another emerging trend is the gradual rise of the US as one of India’s top crude oil suppliers, particularly for light and sweet grades. Kpler data show that India’s crude oil cargoes from the US are around a record 594,000 b/d (as of November 18), compared to 568,000 b/d in October 2025, and against an average 300,000 b/d for the 2025 calendar year so far.

Indian refiners are also increasingly buying crude from South American suppliers such as Brazil and Columbia, and are also procuring crude from West Africa, particularly Nigeria and Ghana.

Published on November 20, 2025