If you’re a beginner trader trying to capture massive gains without risking your shirt, you’ll want to understand how price channels affect stock patterns.

Take “pop stocks,” for example.

Pop stocks are a specific group of companies that react strongly to the upside or downside depending on a catalyst.

They jump on fast news, hype and momentum… often fizzling out just as quickly.

Some of the catalysts that affect pop stock price include…

- Earnings beats

- FDA approval (for biotech drugs)

- Partnerships and buyout rumors

- Big insider buys

- Unusual options activity

- Social media hype (Reddit, X)

While these catalysts can cause a stock to move 10%… 50%… even 100% in a day – they’re also volatile, liquid and driven by emotion.

If you don’t manage risk, you could be left holding a balloon right after someone stops blowing into it.

However, if you can identify a specific price channel, then all you have to do is play these price channels over and over again for consistent profits.

Example of Price Channels in Specific Stocks We’ve Traded

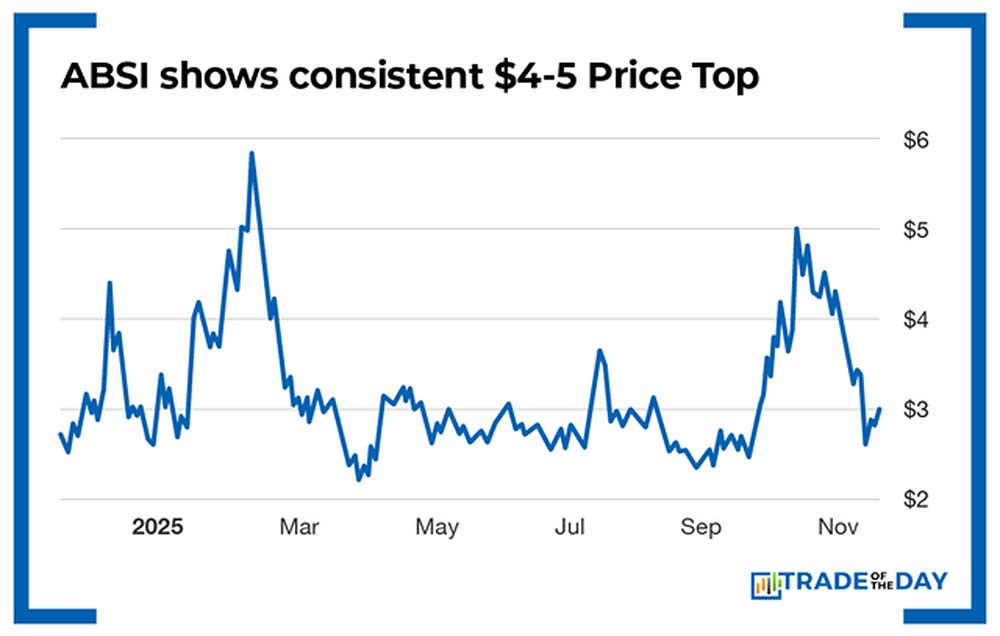

If you look at pop stocks we’ve traded in the past – like Recursion Pharmaceuticals (RXRX) and Absci Corp. (ABSI), both of these plays have a specific price channel.

In the example below, we identified a $4 top price channel on ABSI.

When it gets to $4 or $5, the pattern shows that’s the top.

Same thing with RXRX below.

But instead of $4, it shows a top pattern of around $6-7 and then goes back down.

As a trader, imagine how you could play these channels over and over once you identify them.

Whenever a catalyst is upcoming on RXRX or ABSI, we take note in Catalyst Cashouts. These catalysts, combined with a clear price channel, are how to trade for consistent gains over and over on the same ticker.

Can you play Pop Stocks on the way down?

Yesterday one Cashouts members asked if “they could also play pop stocks on the way down.” Meaning instead of playing them to the upside, they want to play find stocks that are about to drop 10%-100%.

You could do that, but it’d be a lot harder.

You see… some of these pop stocks are so speculative in nature that one day they could fall 50-70% or go up 50-200%.

All it takes is one blog post or one research report that could lead to a massive drop or spike.

Also, companies like ABSI and RXRX don’t have any fundamentals. They aren’t going to have any semblance of revenue from earnings aside from fees that they collect from other pharmaceutical partners.

So instead, we prefer to play short-term catalysts we know have the chance of making the price go up. The longer you hold and wait, the more you risk losing money on a random news item.

![]()

YOUR ACTION PLAN

When it comes to trading pop stocks, the key is to find a clear price channels, know when the stock is hitting its low, and look for an upcoming catalyst that could lead to a “pop.”

We actually announced a new “pop stock” trade in Catalyst Cash-Outs yesterday. Unlike many story-based stocks like ABSI and RXRX, this company has actual revenue and actual earnings.

Click here to login to Catalyst Cash-Outs in case you missed it.