- The EUR/USD weekly forecast indicates a bullish bias, with the dollar under pressure amid growing economic concerns.

- The probability of a December Fed cut reduced from 70% to 50% by Friday due to market caution and lack of visibility into economic data.

- Traders look forward to the FOMC Minutes, NFP, and PMIs for fresh impetus.

The EUR/USD forecast indicates a modestly bullish tone, as the pair trades above 1.1600 after advancing for the second consecutive week, amid steady Eurozone data and mixed Fed signals.

-Are you looking for automated trading? Check our detailed guide-

The Eurozone data offered little support to the shared currency. The Q3 GDP rose by 0.2% QoQ and 1.4% YoY, signaling a stable economic momentum. Industrial production and sentiment data revealed mixed figures.

Meanwhile, some ECB officials and President Christine Lagarde reaffirmed that the central bank remains vigilant and the euro holds a strong position in terms of economic and monetary policy.

From the US, the dollar remained under pressure last week, despite optimism surrounding the end of the US shutdown. Markets awaited the delayed economic release, which the shutdown had halted. Softer labor data pressured the dollar. Meanwhile, hawkish remarks from Fed officials, including Schmid, Kashkari, Bostic, and others, reduced expectations of a December cut.

On Friday, markets priced in a 50% probability of a December Fed cut, down from 70% the previous week. The development stemmed from policymakers emphasizing caution and transparency in the economic conditions before implementing further easing measures. The Fed Chair Powell’s statement regarding uncertainty over the December rate cut contributed to investor cautiousness.

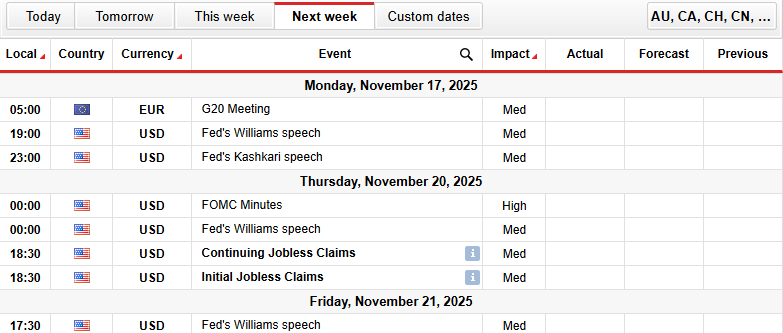

EUR/USD Weekly Key Events

The significant events in the coming week include:

- EUR G20 Meeting

- Fed’s Williams Speech

- Fed’s Kashkari Speech

- FOMC Minutes

- Continuing Jobless Claims

- Initial Jobless Claims

Next week, traders anticipate the FOMC minutes, the G20 meeting, and speeches by Fed officials for further insights into policy cues and global risk sentiment. Markets also expect the long-overdue US NFP report on Thursday. However, the schedule is not clear yet.

EUR/USD Weekly Technical Forecast: Wobbling Near Key DMAs

The EUR/USD daily chart shows the pair in a slight bullish tone earlier in the week after stabilizing above the 1.1600 level. However, the broader trend remains neutral. The upside momentum remains limited, as the pair remains below the key 50-, 100-, and 200-day MAs.

-If you are interested in forex day trading, then have a read of our guide to getting started-

The RSI holds near the mid-50s, indicating fading selling pressure. Breaking above the 1.1650 level could trigger a sustained recovery towards yearly highs. Conversely, failure to hold above the 1.1600 level could lead to renewed downside pressure.

Support Levels

Resistance Levels

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.