Without question, the top trend of the 2025 investing year has been the absolute strength of the AI sector.

We all recognize this.

It’s indisputable…

However, as traders, we can also recognize that trends on Wall Street can sometimes get crowded.

Too crowded.

Trees do not grow to the sky.

So, there could very easily be a time – perhaps coming soon – when we see the AI trade start to unwind.

If this occurs, then we could see traders move into a more defensive position.

This is often times what’s referred to as the “Risk Off” trade.

In other words…

In times of bullishness, Wall Street is on “Risk On” mode.

They buy all of the high-beta names.

They buy the momentum stocks – and keep the upside party rolling.

Buy high….sell higher.

That’s the “Risk On” mentality.

However, once that pendulum shifts, things change fast.

And when it does shift, you don’t want to be that one person left holding the bag.

When the rug gets pullout out, you want to have a plan on precisely what to do next.

That’s what I’ll cover today.

First and foremost, the Utilities Select Sector SPDR Fund (XLU) is a major AI “pick and shovel” play that could offer safety in the time of weakness.

The booming demand for more energy from AI data centers could continue to push these names higher.

Utilities are currently the second-best performing sector this year (up +19% year to date, which is beating the S%P 500’s +11%).

Even if the top AI darlings start to pull back, energy consumption will remain consistent – which could be a nice way to still be positioned in the AI trade without getting exposed to violent draw-downs.

Getting even more defensive…

Let’s focus on consumer staples with high dividends that are trading at attractive values.

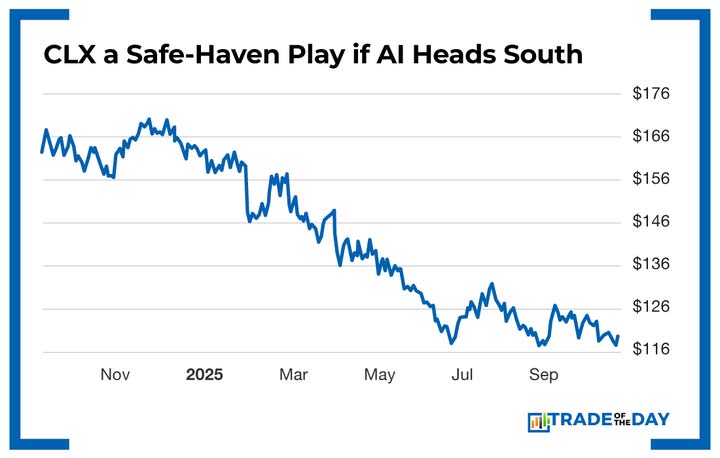

One such candidate is Clorox (CLX), which is down -27% year to date yet offers a 4.2% dividend.

In the midst of market weakness, items like Clorox bleach, Glad trash bags, and Pine-Sol will remain on shopping lists.

A third candidate is Kimberly Clark (KMB), which is down -5.7% year to date and offers a 4.2% dividend.

The maker of Kleenex and Huggies has raised their dividend for 53 straight years – which could offer safety if we see any tech selling pressure.

![]()

YOUR ACTION PLAN

As traders, we can never mistake a bull market for brains. Making money in a bull market is easy. What separates longstanding trading success is having the ability to quickly adapt to a sentiment shift – and continue making money if the prevailing bull trend turns south. If this happens, XLU, CLX, and KMB will be the top three names on my safe-haven watchlist to turn to inside our War Room community.