We just closed another 40%-plus gain in The War Room in 332 trading days using one of my favorite strategies – the spread.

This time it was on the XBI, a biotech ETF.

We make this play nearly every year and it delivers like clockwork since the biotech sector rotates in and out of fashion.

We used a “calendar spread” for this trade.

A calendar spread (also called a time spread) is an options strategy that involves buying and selling options of the same type (calls or puts) and strike price, but with different expiration dates.

Here’s how it works:

- Buy a longer-term option (farther expiration)

- Sell a shorter-term option (near expiration)

- Both have the same strike price and same type (either both calls or both puts)

You’re trying to profit from time decay (theta) and stable prices (low volatility) in the short term.

- The short-term option loses time value faster, benefiting you as the seller.

- The long-term option retains more time value, limiting your risk.

Essentially, you want the stock to stay near the strike price until the short option expires, or in our case, you want the decay on the short call to be far greater than the long call.

As time passes, the short-term option decays faster.

When it expires, you can sell another short-term option against your long one (like renting out time premium repeatedly) or if the stock remains near the strike price, the spread’s value rises because the long option retains more value.

The time to use a calendar spread is when you expect the underlying stock to stay near a certain price (neutral outlook until we get closer to expiration and then you see the long call pick up steam while the short call suffers time decay rapidly.)

Now the strategy is not without risk – no strategy is (even holding cash is subject to inflation risk).

If the underlying shares move up too fast, then you run into a delta squeeze where both options increase in value equally. You may not lose money, but you won’t make as much. If this was anticipated, you would use a vertical spread (we’ll talk about that another time).

![]()

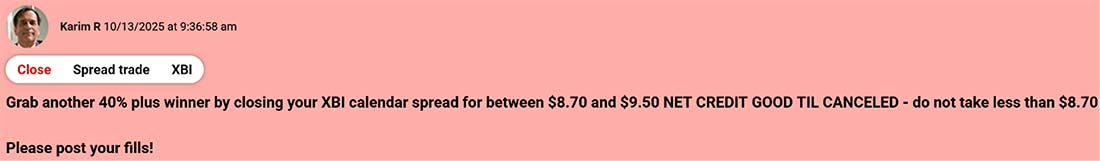

YOUR ACTION PLAN

Calendar spreads are a great way to use time decay to your advantage.

I also issued another trade in The War Room earlier today.