There’s an old saying: In a gold rush, sell shovels. In a war, sell arms.

In the AI boom? Sell servers.

AI data server demand is ramping up fast… as is the profit potential.

OpenAI – the creator of ChatGPT and now valued at $500 billion – just partnered with Nvidia to build 10 gigawatts of these AI data centers.

That’s a big investment… but it’s a small drop in the ocean compared to the energy needed to power the upcoming AI revolution.

So what other companies could profit from this AI server demand?

AI startups seem like the natural bet, but they carry serious risks. Training models cost hundreds of millions of dollars, and these companies can collapse overnight when funding dries up. We’ve seen it happen repeatedly in tech cycles.

So chasing trendy AI stocks is risky.

Instead, I’m watching an established tech company that’s already positioning itself to dominate the AI data race… and one Wall Street had long written off for dead…

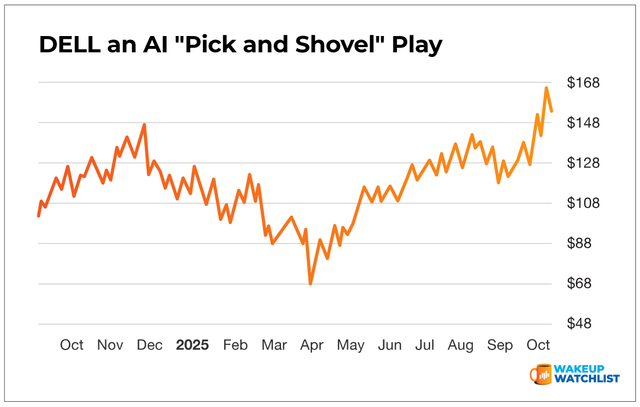

Dell Technologies (DELL).

Here are a few reasons I believe DELL could dominate the AI sector in the coming years…

According to Barron’s, Dell is projecting over $20 billion in AI server sales this year, positioning itself as the leader in the growing AI market.

It’s also estimated to capture 20% of the AI sever market in some quarters (based on GPU-integrated, AI-optimized systems).

Plus, Dell is extremely cheap compared to other AI giants.

It currently trades around 15-16x forward earnings compared to 35-40x of AI giant Nvidia.

So I’m looking at DELL as a “pick and shovel AI play” going forward.

Action Plan: While DELL isn’t a flashy stock, it’s a reliable and affordable play during the AI boom.

I’m watching it in The War Room right now for a potential trade.

I also recently revealed another ETF fund in the energy sector that could also push these AI names even higher. Utilities are the second-best performing sector this year (up +19% to date).

Click here to receive all my AI goldrush plays by joining The War Room today.