I’ve been pounding the table on two sectors all year: oil and gas, and pharmaceuticals. Both have been the most undervalued plays in the market.

This week, that thesis just got a massive catalyst.

The White House announced a breakthrough deal with Pfizer covering everything from tariffs to drug prices to U.S. manufacturing facilities. Pfizer, Eli Lilly, and Merck all ripped higher on the news.

We grabbed quick profits on an Eli Lilly call option in the War Room, and our Pfizer position is sitting pretty in the portfolio.

But here’s what most investors are missing: this isn’t just a news-driven pop. This is mean reversion math finally catching up to reality.

The Numbers Don’t Lie

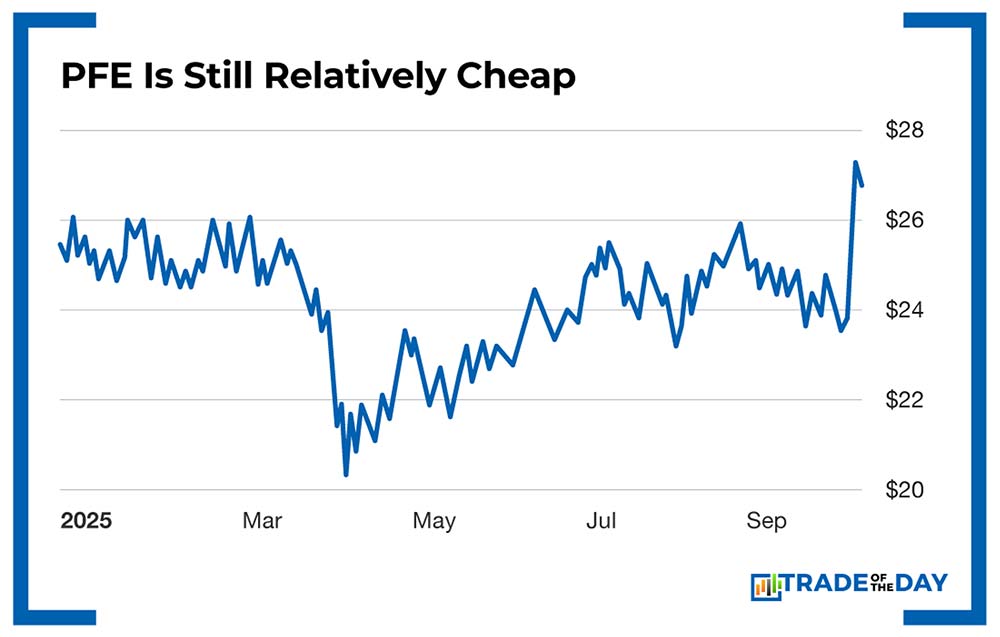

Pfizer’s historical P/E ratio averages between 17-19x earnings. Right now? The stock is trading under 10x earnings.

Let me spell this out: You’re getting Pfizer at roughly half its normal valuation multiple. That’s not a small discount – that’s a mathematical anomaly begging to be corrected.

Mean reversion is simple: when stocks get pushed to extremes, they eventually drift back toward their historical averages. It happens because extreme movements usually aren’t sustainable. Investor sentiment, regulatory fears, or macroeconomic pressures that drive prices to ridiculous levels eventually normalize.

Here’s How This Plays Out

The Setup: Pharmaceutical stocks got hammered on regulatory uncertainty and political noise. Fear drove valuations to basement levels that make no fundamental sense.

The Catalyst: White House deals signal the political headwinds are shifting. Regulatory pressure isn’t disappearing, but it’s becoming manageable and predictable.

The Math: If Pfizer simply reverts to its 17x earnings multiple (the low end of its historical range), you’re looking at an 80% upside from current levels.

That’s not wishful thinking. That’s arithmetic.

![]()

YOUR ACTION PLAN

Mean reversion isn’t guaranteed to happen tomorrow, but it’s one of the most reliable forces in markets over time. When quality companies with solid fundamentals trade at massive discounts to their historical norms, patient investors get paid.

Pfizer isn’t some speculative biotech. It’s a dividend-paying cash machine trading like it’s going out of business. The market is offering you blue-chip pharmaceutical exposure at bargain-basement prices.

The opportunity is mathematical. The timing is now. The risk-reward is tilted heavily in your favor.