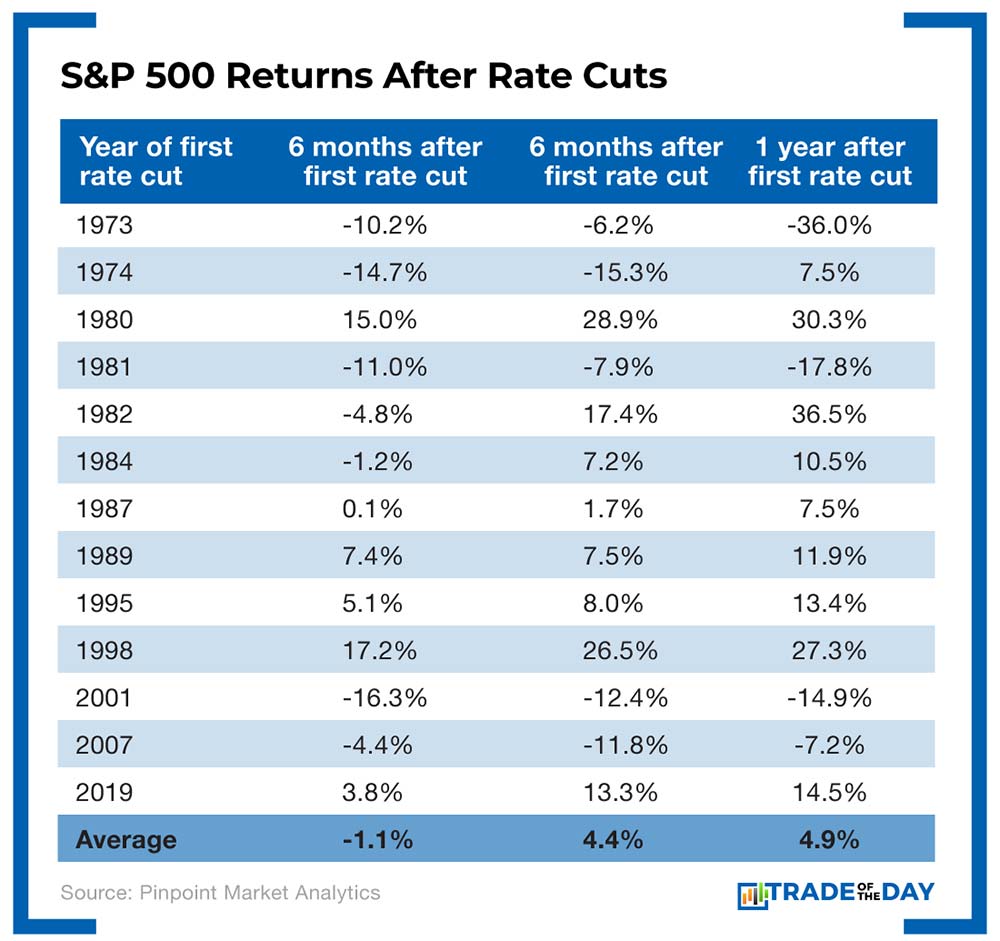

Now that the Fed has started a new rate-cutting cycle, it’s critical for us (as traders) to use history to give us a roadmap of where we expect the major market averages to move.

As you can see below…

Dating back to 1973, the S&P 500 has averaged a -1.1% return 3 months after the first rate cut.

As we head into October, I’ll be taking on a more defensive position headed into the end of the 2025 calendar year.

How am I getting “more defensive?”

The answer is…

“COW” Stocks

We all know that the FANG stocks have been the primary leadership group over the last few years of market gains.

And lately, the Ai group has carried the torch as well.

But now, it behooves us to start looking at the more defensive “COW” stocks, which stands for Costco, O‘Reily Auto Parts, & Wal-Mart.

If we start to see the Ai hangover, as the tech sector begins to unwind, then these three could offer us defensive trades in the midst of any sort of market pullback.

Looking specifically at Wal-Mart, reduced job openings means price conscious consumers could return to bargain shopping. If so, it could benefit Wal-Mart. Re-test of the August $104 high coming?

![]()

YOUR ACTION PLAN

To see the best trades to take – in real time – then you’re invited to join our elite trading group. The first step could be to login to Post Market Profits as we begin the historically strongest month of the year (and it’s not even close).