Prices of major pulses in the global market have dropped to record lows as Canada, Australia, Russia and African nations are engaged in a stiff competition to gain market share. Over the past month, prices have declined between 5 per cent and 20 per cent as the harvest of peas and lentils in these countries’ is good.

Trade analysts say the development does not augur well for Indian farmers as they are either harvesting or set to harvest their crops. Crops such as urad (black matpe), tur (pigeon peas), masur (red lentils) and moth dal (green lentils) are reported to have been affected by August-September torrential rain in various parts of the country.

“Prices of all imported pulses are at new lows. There is hardly any difference in the rates offered by countries such as Canada, Australia and Russia. In particular, prices of yellow peas are at a record low,” said a trader, who did not wish to be identified.

Huge lentils surplus

Traders say for the 2025-26 marketing season (August-July), the area under dry peas in Canada was up 9 per cent at 1.42 million hectares (mh). Yellow pea production is forecast at 3.2 million tonnes, while that of green peas is 550,000 tonnes. As a result, Canada will likely ship out over 2 million tonnes of peas.

Canada’s chickpea crop is projected to be upwards of 340,000 tonnes, with exports likely to be a record high of 235,000 tonnes. Australia is estimated to produce 2.1 million tonnes of chickpeas, down 7 per cent from last year.

A huge surplus is likely on the lentils front. Australia’s lentil production is forecast to increase by 34 per cent to a record 1.7 million tonnes in 2025–26. This is 95 per cent above the 10-year average to 2024–25 in view of a record acreage, Australia’s Department of Agriculture, Fishery and Forests said.

Going by Statistics Canada data, Canada’s lentil crop will likely be a huge one. Based on current yield projections, lentil production is projected at 2.75 million tonnes, a 12-year high.

Other competitors

In addition to these supplies, pulses from the US, Russia, Tanzania, Malawi, Mozambique, Myanmar and Brazil are expected to flood the global market.

Among the pulses crop, only urad has shown a steady trend as Myanmar is running of its inventories from a record crop harvested in January and India’s crop feared to be affected in key growing areas such as Madhya Pradesh, Maharashtra, and Uttar Pradesh

According to data from the Global Pulse Confederation (GPC), only urad (black matpe) prices are ruling steady, with Myanmar quoting $870 (₹77,240) a tonne for the superior quality, while Brazil is offering it at $900 (₹80,000) . Prices have been hovering in this range over the past month.

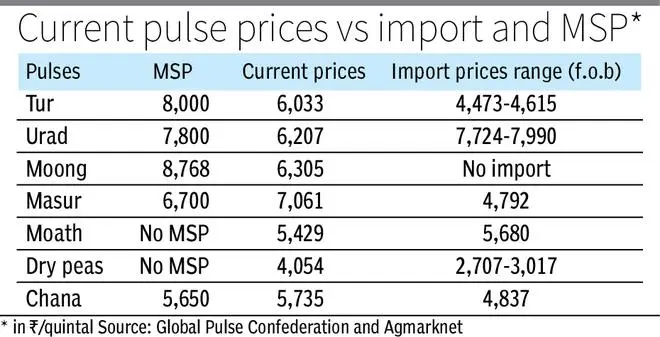

The landed prices are all below the minimum support prices, barring urad, data from GPC and Agmarknet, a unit of the Indian Agriculture Ministry, showed. In the case of tur, urad, masur, yellow (dry) peas and Chana, the domestic prices are lower than landed rates of imports. (See table)

Masoor plunges

In the case of tur, prices have dropped 5 per cent in the past month. Myanmar is offering the pulse at $690 a tonne (₹61,240) a tonne, while African nations such as Tanzania, Mozambique and Malawi have upped the competitiveness offering it at $520 (₹46,150), $540 (₹47,940) and $510 (₹45,275).

The prices of masoor have plunged over the past month with Canada cutting its offer rates by 16 per cent and Australia by 18 per cent. Currently, consignments from Ottawa are offered at $540 (₹47,925) and from Canberra at $530 (₹47,050).

Prices of chana, a rabi crop, have crashed by 20 per cent in the past month with Australian prices falling to $545 (₹48,730) from $690. Yellow peas prices have plunged by 16 per cent in the case of offers from Canada and by 10 per cent in the case of Russia and Ukraine. Canadian yellow peas are now available at $335 (₹29,740) a tonne to India, while Russia and Ukraine yellow peas are priced at $340 (₹30,185).

In the case of moath (green lentils), Canada has cut its prices by 17 per cent and Russia by 18 per cent since August 20. Canada is selling the pulse at $640 (56,820) against $830 in late July. Russia, on the other hand, has cut its offers to $645 (₹57,260) from $765 in the second week of August.

Duty-free imports

Though India does not import green peas, its prices have dropped by 15 per cent in the past month, with Canada’s offers to CHina down to $405 from $475 a tonne.

Traders said the fall in prices of yellow peas to near $300 a tonne is worrisome since its imports single-handedly dragged the pulses market since July 2024. “India imported over 1 million tonnes in the previous fiscal and duty-free imports are not helping,” said a trade analyst.

Imports of tur and urad are also duty-free. All the three pulses enjoy the facility till March 31, 2026. However, in the case of masur and chana, the Centre has imposed a 10 per cent Customs duty.

Published on September 25, 2025