Shares of Patel Engineering are likely to attract investors’ interest in Thursday’s session, November 27, as the company secured multiple orders. The company informed investors through an exchange filing post-market hours today that it has received two Letters of Intent from Saidax Engineers and Infrastructure Private Limited.

These orders are for excavation, composite work, overburden removal including rehandling, coal cutting by surface miner, loading and transportation of coal, as well as hiring of all required plant and equipment, supply of the required quantity of diesel, and complete maintenance of plant and equipment, including required staff and labour for execution of works, which is worth ₹798.19 crore, as per the company’s filing.

The time period of the orders is nine years, and the company also informed that the promoter or promoter group companies have no interest in the entity that awarded the order. It further clarified that the orders do not fall under related-party transactions.

Commenting on the development, Managing Director, Kavita Shirvaikar said, “These new projects represents a natural extension of the large-scale infrastructure works we undertake and also open up new avenues. Importantly, these works come in addition to a robust tender pipeline of more than ₹34,000 crores already bid and under evaluation, as well as further opportunities worth ₹18,000 crores expected to come up for bidding before the end of this financial year.”

Patel Engineering Q2 Performance

For Q2FY26, Patel Engineering’s consolidated revenue from operations stood at ₹1,208 crore, up 2.91% year-on-year (YoY) from ₹1,174 crore in Q2FY25. The company’s consolidated operating EBITDA fell marginally by 2% YoY to ₹159 crore, compared to ₹162 crore in the previous year.

Consequently, the operating EBITDA margin declined to 13.31% from 13.81% in Q2FY25, while the net profit also drops to ₹77 crore from ₹80.7 crore a year ago.

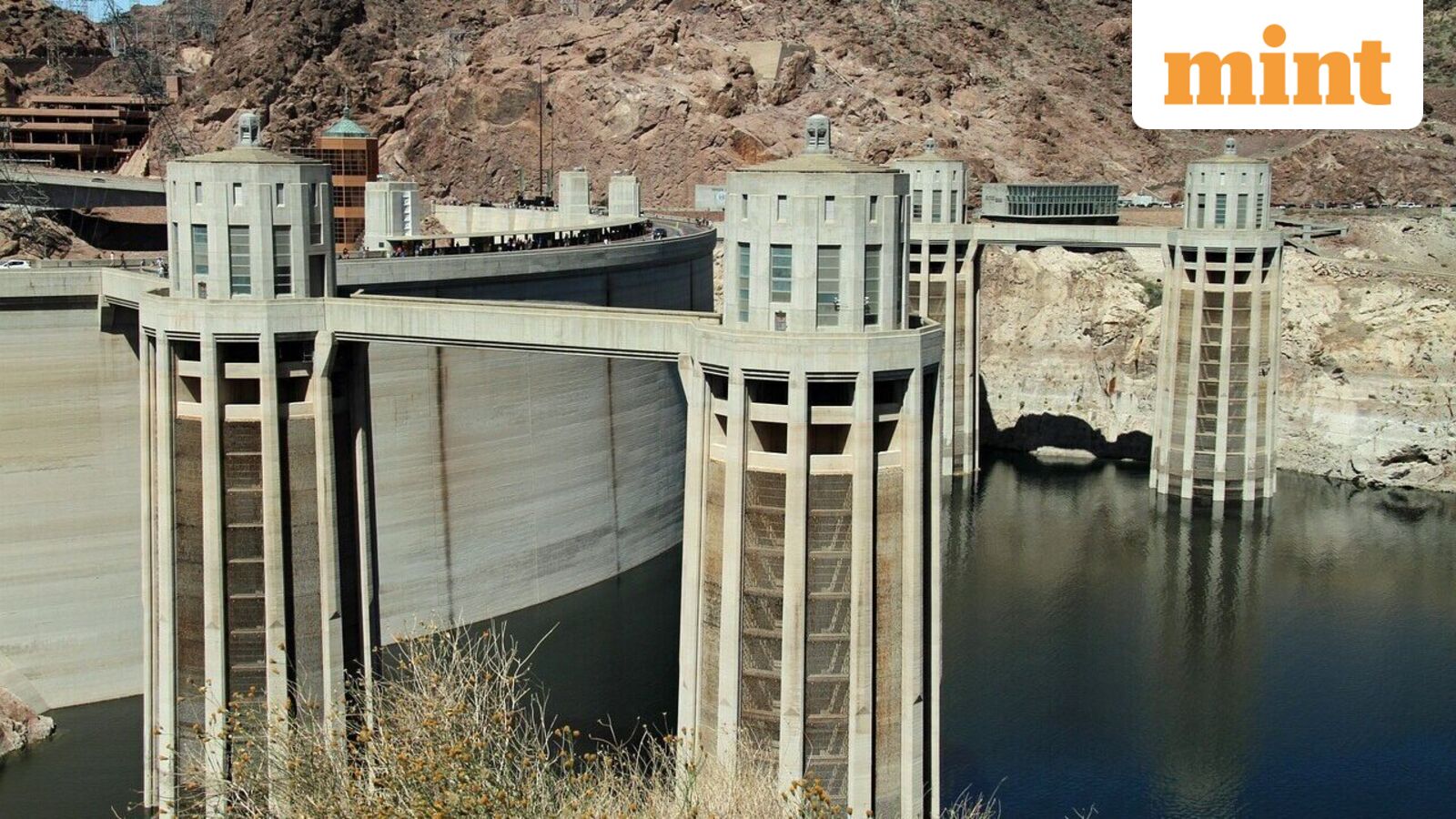

The company’s order book at the end of Q2FY26 stood at ₹15,146 crore, with 62% of the projects belonging to the hydroelectric segment.

The company currently holds 16 hydroelectric projects worth ₹9,373 crore, with key ventures including Subansiri HEP (2,000 MW), Dibang Multipurpose Project (2,880 MW), Kiru HEP (624 MW), Arun-III HE Project (900 MW), Shongtong HEP (450 MW), and Kwar HEP (540 MW), as per the company’s Q2FY26 earnings filing.

Under the irrigation segment, the company holds 21 projects, valued at ₹3,023 crore.

Disclaimer: We advise investors to check with certified experts before making any investment decisions.