- The GBP/USD weekly forecast remains under pressure amid dismal UK economic data.

- The US dollar remains firm amid receding Fed rate cut expectations.

- All eyes on the UK Autumn budget and US inflation data that could shape the market expectations.

The GBP/USD weekly forecast reveals sustained pressure as the soft UK data, like a 1.1% MoM drop in UK retail sales in October, while annual growth came at 0.2%, both well below expectations.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Meanwhile, sterling came under pressure amid growing odds of the Bank of England’s tilt towards a looser policy in the near term due to weaker domestic demand and persistent fiscal concerns ahead of the Autumn budget. The UK PMI data remained mixed, failing to generate any buying traction. On the other hand, the US Federal Reserve signaled caution as inflation remains a risk, shrinking December rate cut expectations. The net effect is GBP/USD staying within a narrow range near 1.3100 after finding a bottom around 1.3050.

Across the Atlantic, the US dollar remains firm after hawkish FOMC meeting minutes that dampened expectations for rate cuts, as revealed by the CME FedWatch tool, to around 35%. The US NFP data exceeded expectations, reflecting 119k jobs added against the expected 55k. The October data is not likely to be released, although some of it will be reflected in the November data, which will be key to watch. Meanwhile, US PMI readings showed a mild improvement, with no significant impact on the US dollar.

GBP/USD Key Events Next Week

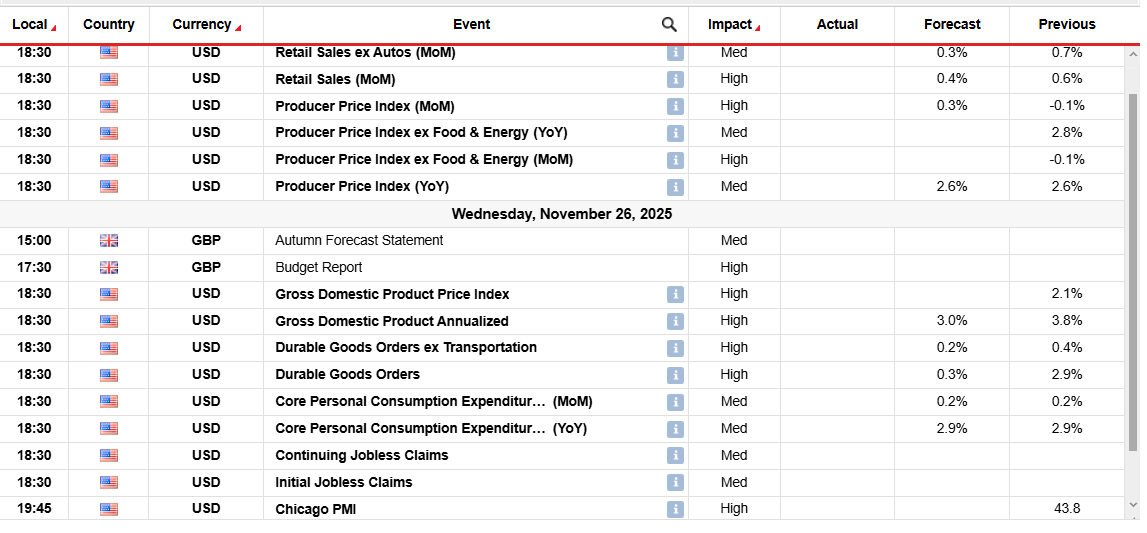

Moving ahead to the next week, the outlook remains tilted to the downside unless sterling receives a positive boost. On the UK side, the market participants will be watching for signs of stabilization in consumer spending after poor retail sales. However, the primary focus remains on the UK budget. In the US, the focus lies on the labor and inflation data, along with further remarks from Fed officials. The significant events scheduled for next week include Core PCE, PPI, Retail Sales, and the GDP Price Index.

GBP/USD Weekly Technical Forecast: Bears paused by 1.3050

The GBP/USD daily chart reveals a weak structure near the broken demand zone. A strong bearish candle, followed by a bearish pinbar, shows the odds of more downside. However, 1.3050 acts as an intermediate support ahead of 1.3000. As UOB states, the pound is unlikely to find a sustained breakout below 1.3000. But a breakout could attract more sellers and test the 1.2900 level.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

On the other hand, any acceptance above the 1.3100 area could gather buying momentum and aim to test the 1.3200 level. While the RSI has begun rising from the oversold region, it remains below 50.0, indicating neutral momentum.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.