- Samsung lifts memory-chip prices up to 60% as AI-driven shortage intensifies

- Japan’s JGB yield rise sparks alarm, but fears of a global liquidity shock are overblown

- China cracks down on “zero-mileage” auto exports used to inflate sales and claim tax perks

- RBA’s Fry-McKibbin rejects claims review urged equal weighting of inflation and jobs

- Japan 2026 huge crypto overhaul: tightening oversight, slashing taxes, insider trading law

- Japan sends envoy to China after Beijing protests Takaichi’s Taiwan comments

- Berkshire reveals $4.3bn Alphabet stake, adding Google to its top holdings

- Japan’s Q3 GDP shrinks 1.8%. Tariffs hit exports, contraction milder than expected – recap

- PBOC sets USD/ CNY reference rate for today at 7.0816 (vs. estimate at 7.0956)

- Tragic news: At least 32 killed after bridge collapses at DRC copper & cobalt mine

- Japan’s eco min eyes terrible Q3 GDP report – will compile economic stimulus plan swiftly

- Trump signals possible talks with Maduro as U.S. escalates military and legal pressure

- Singapore’s exports (NODX) surge 22.2% in October, driven by gold & stronger region demand

- China’s hidden gold buying may be 10× official data as de-dollarisation accelerates

- UK home asking prices black hole, biggest seasonal fall since 2012 ahead of Reeves’ budget

- Japan Q3 GDP -0.4% q/q (expected -0.6%). Preliminary reading.

- Nomura warn China export slowdown exposes deeper structural strains as growth trends weakn

- ECB’s Rehn warns inflation may slow too much, flags risk of equity-market correction

- Bostic signals caution on December rate cut, says data must guide next Fed move

- Trump attack on Venezuela imminent? Says President Maduro heads a terrorist organization

- Want some inside info? Here’s what Trump is personally buying according to ‘Ethics’ office

- Japan expected to unveil ¥17tn stimulus focused on cost relief and AI–chip investment

- Economic calendar in Asia – Japan GDP Q3 (preliminary), shrinkage expected

- New Zealand data: October Food Price Index -0.3% m/m (prior -0.4%)

- New Zealand October services PMI higher at 48.7 but still in contraction (prior was 48.3)

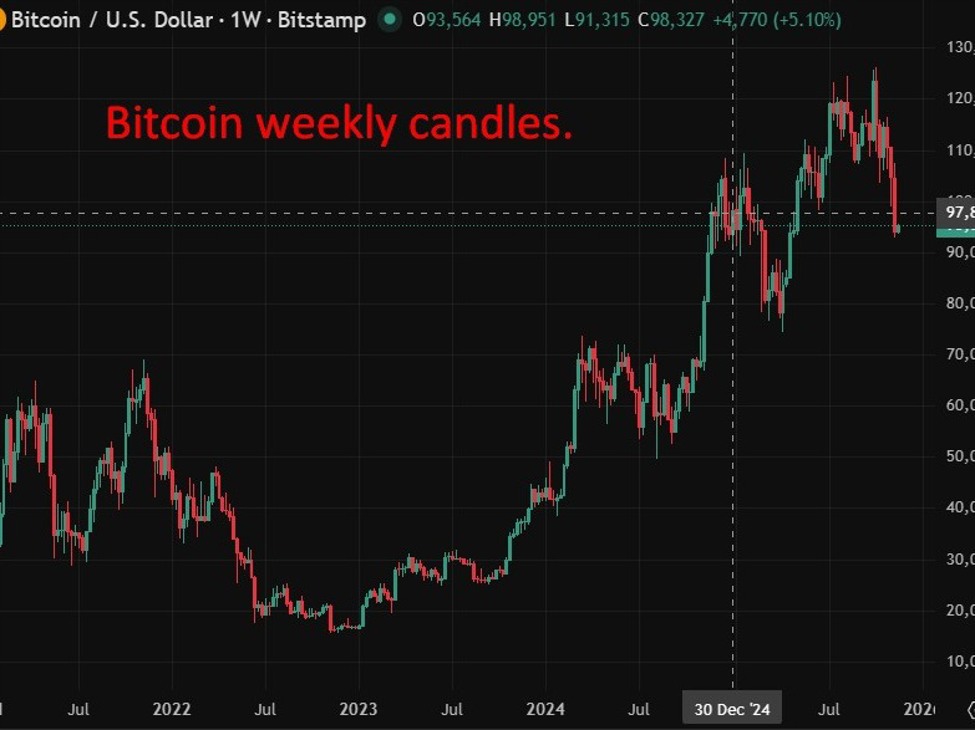

- Did you have a good weekend? Bitcoin: “No ;-( “

- US Treas Sec Bessent uses the four-letter word on China agreement – ‘hope’

- Monday morning open levels – indicative forex prices – 17 November 2025

- Newsquawk Week Ahead: NVDA earnings, FOMC Minutes, RBA Minutes, UK, Canada and Japan CPI

- Fed Kugler dirt: Filings show Kugler made dozens of banned trades before key Fed meetings

Over the weekend we had a cluster of central bank commentary:

• Fed: Atlanta Fed President Raphael Bostic signalled caution on supporting another rate cut in December, saying he’s not yet convinced the data justify further easing.

• ECB: Olli Rehn warned euro-zone inflation could undershoot the 2% target due to low energy prices, a stronger euro and moderating wage pressures. He didn’t rule out a December cut but flagged upside risks too.

• Fed ethics: Former Fed Governor Adriana Kugler is under fresh scrutiny after newly released ethics filings revealed dozens of trades that violated the Fed’s strict personal-trading rules. Kugler resigned on Aug. 1. There remains debate over whether the trades were hers or her husband’s, but the breaches made her position untenable.

Japan also featured heavily in weekend news flow. The government is preparing a stimulus package of more than ¥17 trillion aimed at alleviating cost-of-living pressures and boosting investment in AI, semiconductors and broader economic growth. Cabinet approval is expected Friday.

From late-Friday filings, Berkshire Hathaway disclosed a new $4.3bn stake in Alphabet, now its 10th-largest holding. The news helped lift Nasdaq emini futures during the Sunday Globex session.

Back to Japan: preliminary Q3 GDP showed an annualised contraction of 1.8%, milder than the -2.4% expected but still the first decline in six quarters and the joint worst since 2023. JGB yields continued to climb, with the 10-year hitting its highest level since 2008. After nearly two decades of zero-to-negative rates and abundant liquidity, this repricing is a meaningful shift for global markets. Even if the Fed delivers another 25bp cut, it won’t offset the structural implications.

The era of effectively free Japanese money — a major pillar of global asset support for two decades — is fading. Bond markets are signalling that the adjustment has begun, and it is unlikely to be smooth.

On geopolitics, tensions between Tokyo and Beijing escalated. Four armed Chinese Coast Guard vessels briefly entered waters administered by Japan near the disputed East China Sea islands. China then issued travel and study warnings to its citizens regarding Japan. Tokyo will dispatch senior Foreign Ministry official Masaaki Kanai to Beijing today to try to stabilise relations after China’s sharp response to Prime Minister Takaichi’s recent Taiwan-related comments. Japanese shares fell.

In the Americas, U.S. Secretary of State Marco Rubio said the State Department intends to designate Cartel de los Soles, which Washington alleges is headed by Venezuelan President Maduro, as a Foreign Terrorist Organization (FTO). Rubio accused the group of corrupting Venezuelan institutions and working with other FTOs in drug trafficking. Trump later said the U.S. “may be having some discussions with Maduro,” even as the American military presence near Venezuela continues to build.

Despite all this, major FX pairs traded in relatively subdued ranges, with a modest bid into the USD. EUR, AUD, NZD, GBP and JPY are all slightly lower. Gold was largely sideways, and oil drifted modestly lower.

U.S. equity futures traded higher in the Sunday session, helped by the Berkshire-Alphabet news (though it was Buffett’s lieutenants rather than Buffett himself doing the buying).

Bitcoin, meanwhile, fell sharply — at one point giving back all of its year-to-date gains and briefly turning negative for 2025.

Asia-Pac

stocks:

- Japan

(Nikkei 225) -0.33% - Hong

Kong (Hang Seng) -0.8% - Shanghai

Composite -0.43% - Australia

(S&P/ASX 200) -0.06%