- The AUD/USD weekly forecast indicates bearish momentum despite the resilient Australian dollar.

- Australia’s unemployment data fell to 4.3% in October, with an addition of 42.2k jobs.

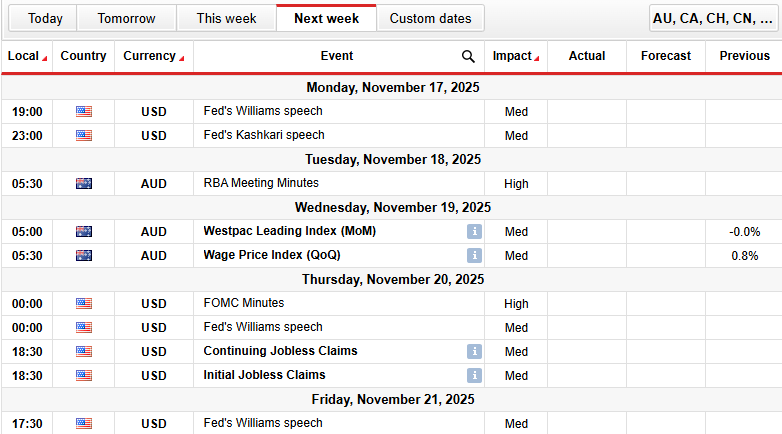

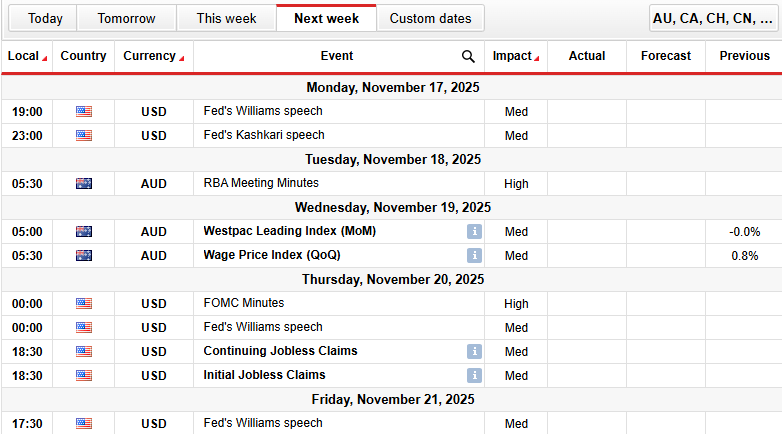

- Traders anticipate the FOMC and RBA meeting minutes along with speeches by Fed officials next week.

The AUD/USD weekly forecast reflects a broader selling pressure, as the pair closed under 0.6550 by the end of the week. Despite an earlier rebound, the lifted greenback and an uncertain Fed policy stance weighed on the pair. However, the Australian dollar remained resilient amid strong domestic data and a stabilizing situation with China.

-Are you looking for automated trading? Check our detailed guide-

The previous week’s unemployment data revealed a drop to 4.3% in October, with an increase in employment by 42.2k. Meanwhile, 55.3k full-time positions were added to the economy. These figures point towards a cautious RBA stance for 2025.

China’s upbeat data, showing a 4.9% rise in industrial production and 2.9% growth in October retail sales, further lifted the Aussie. However, if China’s economic growth declines, it could weigh on the AUD.

From the US, the dollar remained pressured due to the uncertain economic outlook this week. The federal shutdown had halted the release of primary economic data, leading to a volatile and uncertain situation regarding inflation and employment figures.

Meanwhile, reduced expectations for a December Fed cut, down from 70% this week to 50% on Friday, slightly lifted the greenback. Hawkish Fedspeak revealed caution about further monetary easing, boosting the dollar despite prevailing economic concerns.

AUD/USD Key Events Next Week

The significant events in the coming week include:

- RBA Meeting Minutes

- Westpac Leading Index (MoM)

- Wage Price Index (QoQ)

- Fed’s Williams Speech

- Fed’s Kashkari Speech

- FOMC Minutes

- Continuing Jobless Claims

- Initial Jobless Claims

In the coming week, traders will look forward to the continuation of initial jobless claims and the Fed’s official speeches for further policy direction. Additionally, next week’s RBA meeting minutes and FOMC minutes will guide traders on the economic outlook and future interest rate decisions.

AUD/USD Weekly Technical Forecast: Consolidation Above 0.6500

The AUD/USD daily chart indicates the pair is in a neutral phase, trading above 0.6500. The price remains above the 50- and 200-MA, suggesting some support near the 0.6500 and 0.6460 levels.

-If you are interested in forex day trading, then have a read of our guide to getting started-

The RSI holds near 50, indicating a consolidation, as markets await a catalyst to initiate a breakout. A break above 0.6550 could ignite the upside continuation. On the contrary, a break below 0.6500 could trigger downside pressure towards 0.6400 and 0.6350.

Support Levels

Resistance Levels

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.