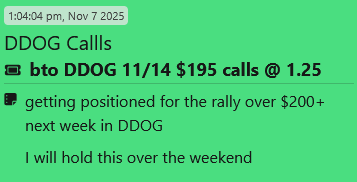

Last Friday, I wrote about how DDOG was screaming “buy” after its latest earnings beat.

I believed the AI group had more room to run, and I was looking for a break closer to all-time highs around $200.

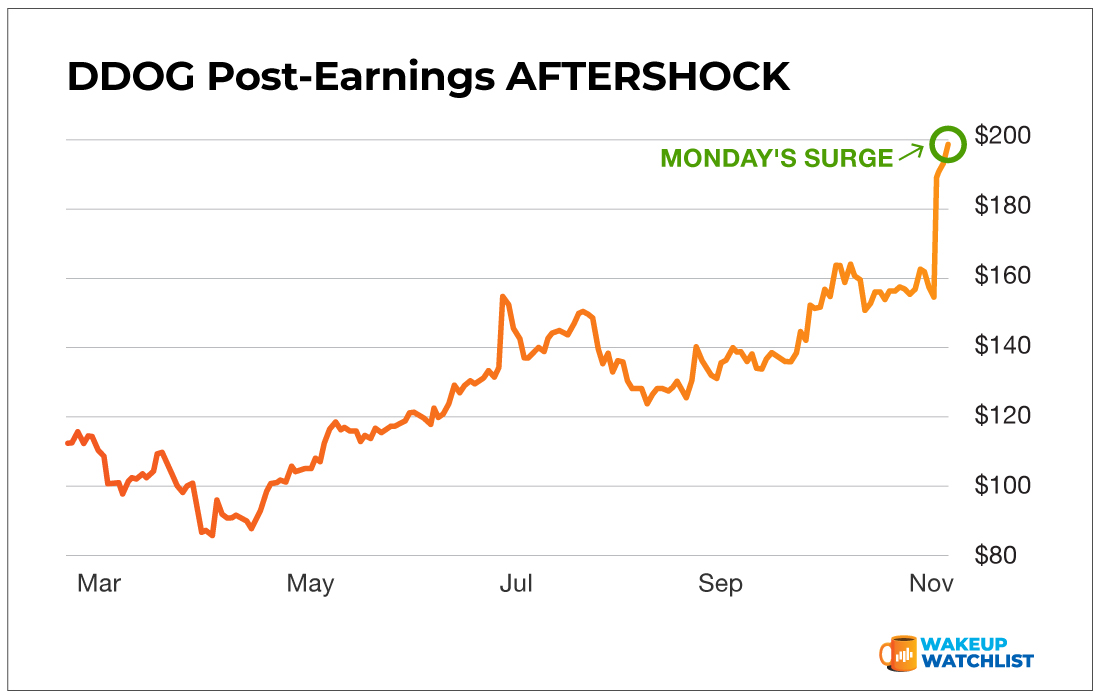

So I got positioned on Friday in both Daily Profits Live and Profit Surge Trader.

I held over the weekend to wait for the next surge to happen on Monday.

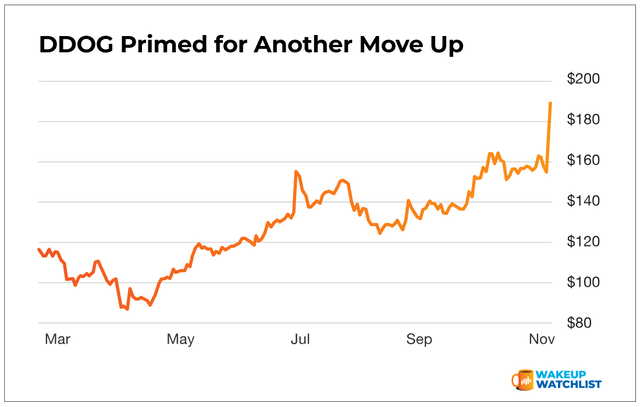

And yesterday morning – that AFTERSHOCK move came in a big way.

DDOG shot up to $198 from $192 after the opening bell, inching closer to its all-time highs. It would later cross the $200 mark by lunchtime.

The Daily Profits chatroom was electric, and I ended up closing a 300% winner in 3 trading days.

This DDOG move is a perfect example of a “post-earnings AFTERSHOCK.”

Check out the “before” chart below from Friday morning.

Now look at the post-earnings surge on Monday morning.

I know it sounds too simple, but all you have to do on these post-earnings trades is ride established momentum.

Several Daily Profits Live members were also in on this trade.

Here’s what they had to say…

“I scaled out my 2 DDOG options @$75 for 102% and @$85 for 129% gain. Thank you NB – David Mc45

“Out of my 1 DDOG at 100%” – CALinPgh

“DDOG in 120 out 2.3 on 11/21 210’s. Thanks Nate.” – Doug65

As a watchlist subscriber who also had intel on play, I must ask… did you catch this move on DDOG?

If you missed this trade, no worries.

I’m already looking to get back in DDOG on the next pullback.

Action Plan: Post-earnings Aftershocks are a chance to trade earnings winners for multiple gains without risking your shirt by guessing which direction a stock will go pre-earnings.

If you’re available to make just ONE trade before 9:30 a.m., you can make these trades too.

By trading the aftershock, you already know how earnings will turn out.

And you can still make up to 300% in less than a few hours.

Click here to join today and receive all of my post-earnings trade alerts in real time.