Image source: Getty Images

Elon Musk’s new Tesla (NASDAQ:TSLA) compensation package offers huge rewards for getting the stock to surge for a valuation of $8.5trn in the next 10 years. That’s 530% above the current level.

The company says the CEO gets nothing unless ambitious targets are met. But I don’t see how some of the targets count as ambitious in any sense.

Details of the deal

I think the deal gives Tesla shareholders a lot to look forward to. In its proxy statement to investors, though, the firm said the following:

“The 2025 CEO Performance Award is designed to supercharge Tesla’s next era of growth. There are no layups. Elon gets nothing unless he (1) delivers on bold market capitalization goals and (2) leads Tesla for at least 7.5 more years.”

Bold? I’m don’t think so. The deal comes in 12 parts, each of which involves achieving a certain market-cap and meeting an operating milestone.

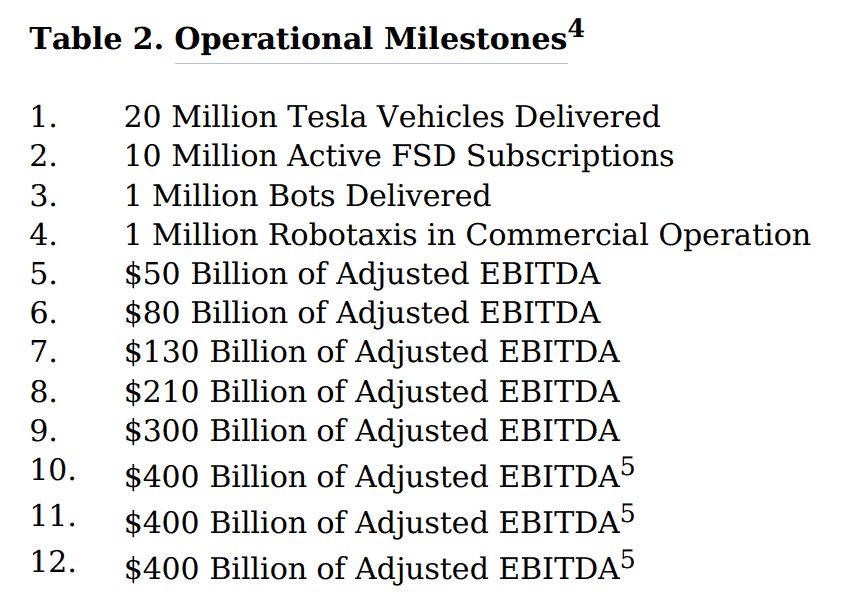

The market-cap milestones begin at $2trn, then go up in $500bn increments to $6.5trn, then in $1trn increments to $8.5trn. And the operational conditions are the following:

Source: Tesla 8k filing 6.11.2025

I think Tesla shareholders should happily give Elon the full compensation if this happens. But some of these look pretty unambitious to me.

Market-cap milestones

A couple of things immediately stand out to me. The first is that Tesla’s market value is currently $1.35trn and the first milestone is $2trn – 48% above the current level.

Achieving this in the next 10 years involves pushing the company’s market value up by 4% a year. That’s well below the annual return from the S&P 500 recently.

To get to something more like what an investor might be hoping for, Tesla’s market value needs to get to around $4trn by 2035. But that’s the fifth level.

I’m therefore not convinced that the first four market-cap milestones really impose anything that might be called bold targets. To me, they simply look more like not underachieving.

Operating milestones

The 20m vehicle target also seems odd. And this isn’t just because it’s unusual to tie a CEO’s compensation to car sales when executives and shareholders insist it isn’t a car company.

It’s because the firm’s 8k specifies that the 10m delivery target isn’t from this point forward, but “from the time of the first delivery of a Tesla vehicle.” That was back in 2008.

According to estimates, Tesla has already delivered around 8.5m vehicles, so it needs 1.2m a year more to hit the target within 10 years. And it delivered 1.8m in 2024 (the last full year).

Again, I’m not convinced this is a bold target. It involves delivery numbers not falling away from their current levels, but I don’t think that counts as ambitious.

$8.5trn?

Tesla stock didn’t really move after shareholders voted through the new compensation plan. And I think there are two reasons for this.

One is that it was sort of an open secret that this was happening. And the stock market generally reacts to surprises.

The other is that this isn’t entirely shareholder-friendly. If the company’s market value goes up by 4% a year, investors are likely to be disappointed, but Musk gets just over 35m shares.

Ultimately, this is why I don’t own Tesla shares. The potential is really exciting, but what’s likely or realistic is another question.