- The GBP/USD weekly forecast remains mildly bullish as the US dollar weakens on a continued US government shutdown.

- The central bank is likely to move towards further easing, while the Fed stays data-dependent.

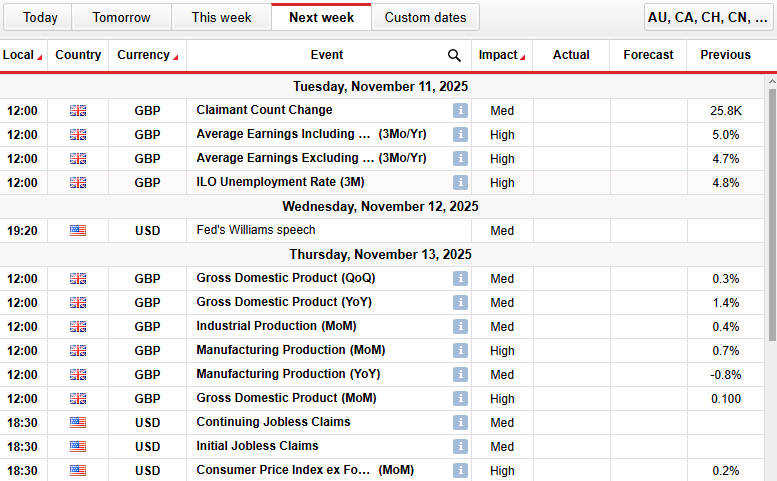

- Traders await GBP manufacturing and average earnings reports, along with the US consumer price index and retail sales the next week.

The GBP/USD weekly forecast tilts slightly up after paring BOE-led losses on Friday, closing above the 1.3150 level. The move stemmed from the US major data blackout amid a continued government shutdown.

As the Bank of England kept the rates unchanged at 4%, it came along with a readiness, instead of the previous cautiousness, to resume rate cuts from the December meeting. MPC members’ vote revealed a 5-4 split, with the Deputy Governor Sarah Breeden also favoring the majority for a 25 bps rate cut, highlighting the growing concerns about the UK’s sluggish growth and cooling inflation.

–Are you interested in learning more about XRP price prediction? Check our detailed guide-

The BoE also emphasized that the CPI figures have already found a top and is poised for further slowdown. Markets now price in a 70% chance of one December cut and a probability of 50 bps easing in the next year.

On the other hand, the greenback regained renewed strength amid resilient labor data and moderate disinflation. However, the Dollar Index (DXY) reached a six-month high near 100.36 this week before slipping to 99.45 by Friday. Fed’s Jefferson noted that the central bank should gradually proceed with further easing as the policy approaches a neutral rate and should decide further moves based on the upcoming economic data.

According to CNN, Kevin Hassett, the White House economic advisor, noted that the economy is in jeopardy because of the current shutdown, anticipating a contraction of 1-1.5% in GDP growth this quarter. The shutdown has obstructed key data releases, causing limited visibility in the markets, with investors shifting to secondary data sources for near-term market clues.

The UoM Consumer Sentiment revealed that the consumer sentiment slipped to 50.3 from 53.6 in October. Together, these developments weigh on the greenback and limit the dollar’s further upside.

GBP/USD Key Events Next Week

The significant events in the coming week include:

- GBP Average Earnings Including Bonus (3Mo/Yr)

- GBP Average Earnings Excluding Bonus (3Mo/Yr)

- GBP ILO Unemployment Rate (3M)

- GBP Manufacturing Production (MoM)

- GBP Gross Domestic Product (MoM)

- US Consumer Price Index ex Food and Energy (MoM)

- US Consumer Price Index ex Food and Energy (YoY)

- US Consumer Price Index (YoY)

- US Consumer Price Index (MoM)

- US Retail Sales (MoM)

- US Producer Price Index (MoM)

Next week, US inflation data remains the key driver. However, it is important to see whether the data will be released or not. Continued weakness in CPI reading could prompt the Fed to cut further in the December meeting.

GBP/USD Weekly Technical Forecast: Weak Recovery Attempt Capped by 1.3180

The GBP/USD daily chart shows a corrective rebound from 1.3020 up to 1.3180 before closing the week near 1.3150. The price remains well below the 50-, 100-, and 200-day MAs, reflecting sellers’ dominance. Meanwhile, 100- and 200 MAs are looking to form a bearish crossover.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The RSI is near 40, indicating limited upside strength. A sustained move above 1.3180 could extend gains towards 1.3260 and 1.3340. Conversely, a drop below 1.3100 could intensify the selling pressure and trigger a downside towards 1.3000 and 1.2890.

Support Levels

Resistance Levels

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.