The ICP price has staged a strong comeback over the past few weeks, rising from its year-to-date low of $1.56 in October to a high of $8.86, a 480% surge.

Summary

- ICP price has jumped by over 385% from its lowest level in October.

- The jump is mostly because the developers recently launched Caffeine, an AI platform.

- ICP’s volume in the spot market and the futures open interest has soared.

Internet Computer (ICP) token was trading at $7.65, giving it a market capitalization of over $4.15 billion. Its daily trading volume jumped to $1.50 billion.

The ICP price jumped as the network pivoted to the artificial intelligence industry by launching Caffeine. Caffeine, a platform powered by Internet Computer, allows users to build websites and applications without any coding.

Instead, anyone can easily build these products by describing them just as they do on ChatGPT and Claude. After doing this, the platform writes the code within minutes.

This platform has now transitioned ICP into an AI token, which is notable given the industry’s ongoing growth. Other AI tokens, such as Filecoin, Near Protocol, and the Artificial Superintelligence Alliance, were up by over 18% in the last 24 hours.

ICP’s price is also rising as its ecosystem continues to grow. Its stablecoin supply has jumped by almost 30% in the last seven days to over $5 million. Also, the total value locked in its ecosystem has jumped to $54 million, its highest figure since January.

More data shows that the DEX volume on its platform jumped to $3.85 million in the last 24 hours, its highest level in almost a week.

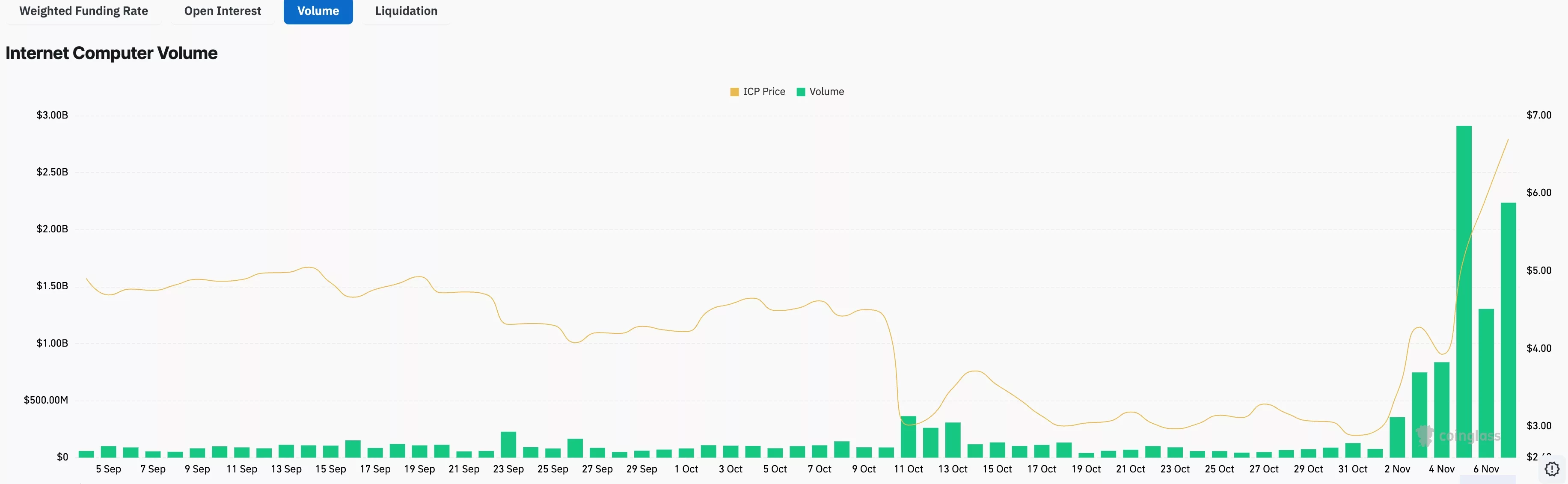

Meanwhile, there are signs of more demand in the spot and futures markets. Its futures open interest jumped to a yearly high of over $206 million from last week’s low of $40 million. Also, the daily volume has soared to over $1.5 billion, up from this month’s low of $75 million.

ICP price technical analysis

The daily timeframe chart shows that the Internet Computer token bottomed at $1.62, which coincided with the extreme oversold of the Murrey Math Lines indicator.

It has now rebounded as investors buy the dip. Consequently, it has jumped above the key resistance level at $6.22, the upper side of the horizontal channel where it remained between February and October.

The token has moved above the 100-day moving average and the Major S&R level of the Murrey Math Lines. Therefore, the most likely ICP price forecast is bullish, with the next target being the ultimate resistance at $9.35.