There’s a huge demand for short-term cash right now,

Utility costs are rising, with residential electricity prices up 11% this year.

Credit card delinquencies also rose 7% over the same timeframe, so borrowing money is becoming a less viable way for consumers to deal with rising costs.

It’s why I recommended First Cash Holdings (FCFS) in Catalyst Cash-outs a few weeks ago.

You see… FCFS is one of the few companies that offers one of the oldest forms of banking – bartering.

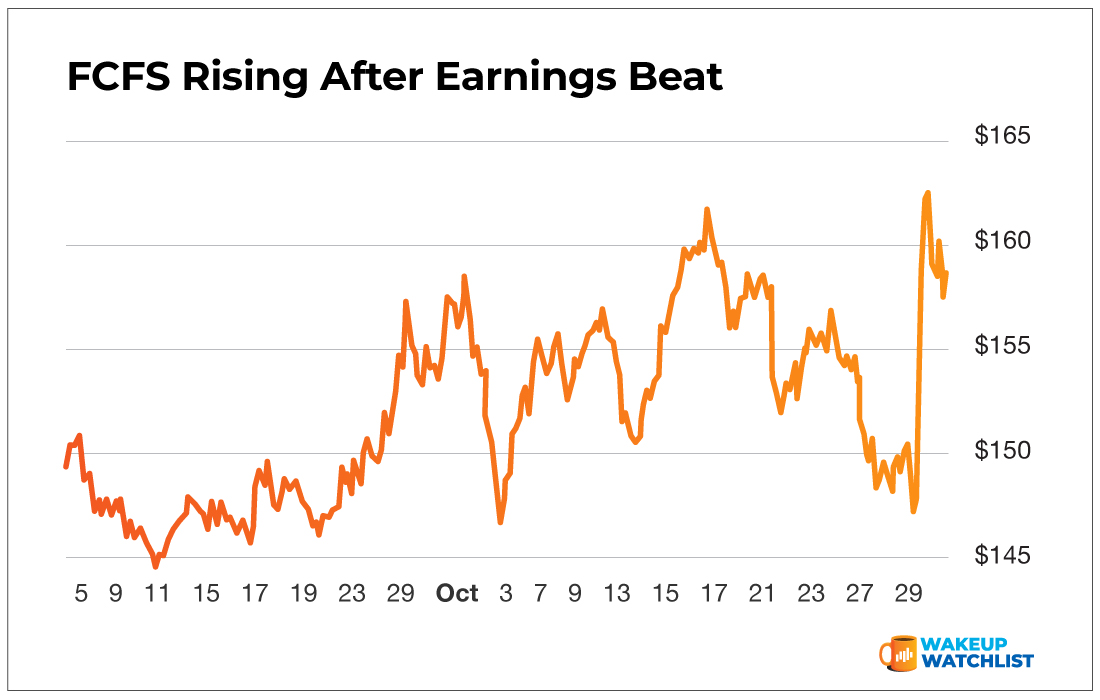

Due to high-demand for fast money, FCFS stock is on a historic run.

Last Friday, it soared to 52-week highs after beating earnings. It’s now up 44% year-to-date, and 58% since the beginning of the year.

But despite its historic run, almost nobody is talking about FCFS.

Investors are focused safe-haven metal plays like Freemont McMoran (FCX) or SPDR Gold Shares (GLD).

Yet even with its recent run up, I believe FCFS is still undervalued.

It’s currently trading at 17x forward 2025 revenues. Over the last decade, that number has been around 23x.

FCFS also recently acquired a group called H&T group, which is essentially the largest pawn broker in the United Kingdom. So now it’s an entirely global play to play America’s oldest form of banking.

It also pays a 1.2% dividend and it’s recession-proof since most people will still need cash in the event of a recession.

So in short – everything is lining up for FCFS to continue its record growth.

Action Plan: Right now, options are expensive on FCFS, so a simple “buy and hold position” is how I’m trading it in Catalyst Cash-outs. Missed this play because you’re not a member of Catalyst Cash-outs? That’s ok! You can get the details on another undervalued play, one that’s personally back by President Donald Trump.

It’s an American energy company that’s combining artificial intelligence with energy, and because it’s so profitable, my trading partner Karim Rahemtulla believes it has nowhere to go but up.

Click here to join Catalyst Cash-outs and unlock Karim’s rare “unicorn” play.