Image source: Getty Images

The SIPP, or Self-Invested Personal Pension, is one of the most flexible and tax-efficient ways to save for retirement.

For anyone reaching 40 with little or no savings, the idea of building a £500k pension pot might seem out of reach — but it’s not impossible.

With disciplined contributions, smart investing, and the power of compounding, it’s still achievable over a 25-year horizon.

A SIPP allows investors to choose their own funds, shares, bonds, or ETFs, giving greater control over long-term returns compared with traditional workplace pensions. The key is starting now and sticking to a well-diversified, growth-focused strategy.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Still time to compound

The magic of investing over a long period of time is compounding. This is when our investment start generating returns on previous returns. This is exponential growth.

So, how would one create a £500,000 SIPP from the age of 40? Well, here’s one theoretical calculation.

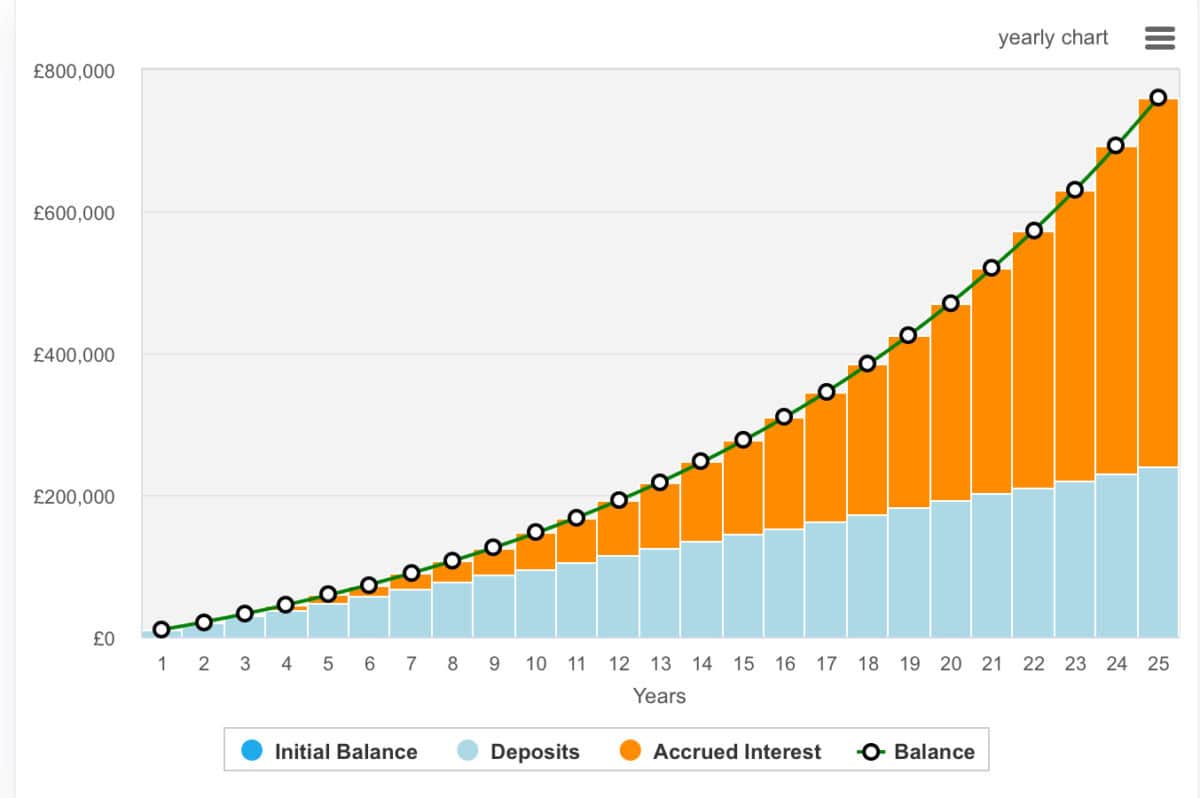

If a saver puts £640 per month into their pension, and then receives basic tax relief of 20%, the total monthly investment would be £800. Assuming 8% annualised growth, this portfolio would reach £500,000 in 20.5 years.

In turn, this could generate an income worth around £20,000 per year. It might not be enough to retire on, but it’ll be complemented by the State Pension when that age — whatever it may be in 20/30-odd years — kicks in.

The reality is that anyone looking to rely on the SIPP to take an early retirement may need a few more years of compounding.

That’s because after 25 years, this portfolio would be worth £760,000. That means it could deliver more than £30,000 annually.

The longer we let it grow, the more impressive the rate of growth.

Where to invest?

The tricky part is knowing where to invest. Many novice investors will start by taking positions in diversified investment opportunities. This includes vehicles like ETFs or trusts.

One great place to start is Baillie Gifford’s Scottish Mortgage Investment Trust or even The Monks Investment Trust (LSE:MNKS).

The Monks Investment Trust offers investors an enticing route to long-term capital growth through a globally diversified equity strategy.

Rather than chasing short-term gains, Monks focuses on businesses addressing major global challenges in innovative ways. This includes those capable of reducing costs or transforming the quality of services.

The trust’s portfolio includes household names such as Nvidia, Microsoft, and TSMC, alongside differentiated holdings like The Schiehallion Fund.

It has outperformed the FTSE All World Index over one year and 10 years, although it lags on a three- and five-year basis — it’s up 293% over 10 years.

However, investors should be aware that the trust is leveraged. This means it uses borrowing to finance some of its investments. Great when stocks are moving up, but less good when they’re in reverse.

Today, it’s trading at a 5.3% discount to net asset value (NAV) and with low ongoing charges of 0.43%, Monks represents an option worth considering.