- The AUD/USD weekly forecast remains cautious as investors balance stronger US dollar demand against firmer Australian inflation data.

- The Australian CPI exceeded expectations, declining expectations for further RBA easing.

- Traders anticipate commentary from Fed officials, RBA policy decisions, and nonfarm payrolls for more impetus.

The AUD/USD weekly forecast remains subdued, as the pair trades near 0.6540 with a steady US dollar amid the Fed’s cautiousness and shifting risk sentiment. The greenback gained support from expectations of less dovish Fed rate cuts. Fed Chair Jerome’s cautious remarks regarding a December rate cut lifted the dollar further.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The investors remained defensive as interest rates declined to 3.75%-4.00%, while data seemed limited amid the prolonged US government shutdown. Meanwhile, the US Dollar Index climbed to 99.70, marking its three-month high.

From Australia, the domestic inflation data came in stronger than expected. The trimmed mean CPI for Q3 rose to 1.0% QoQ and 3.0% YoY. While the monthly CPI increased to 3.5% YoY, it limited hopes for another rate cut by the RBA in the near term. Governor Bullock emphasized a tighter labor market, reaffirming the RBA’s cautious stance.

Additionally, given the trade connections between Australia and China, the manufacturing PMI dropped to 49.0, signaling contraction. Meanwhile, the non-manufacturing PMI rose to 50.1. This mixed data and the progressing China-US trade situation kept Aussie in a delicate balance.

AUD/USD Key Events Next Week

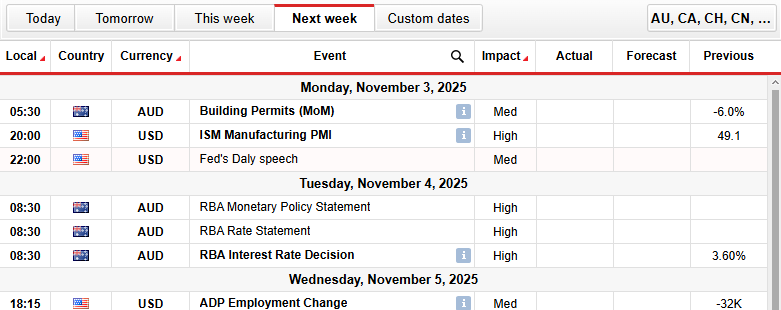

The significant events in the coming week include:

- USD ISM Manufacturing PMI

- RBA Monetary Policy Statement

- RBA Rate Statement

- RBA Interest Rate Decision

- Fed’s Daly Speech

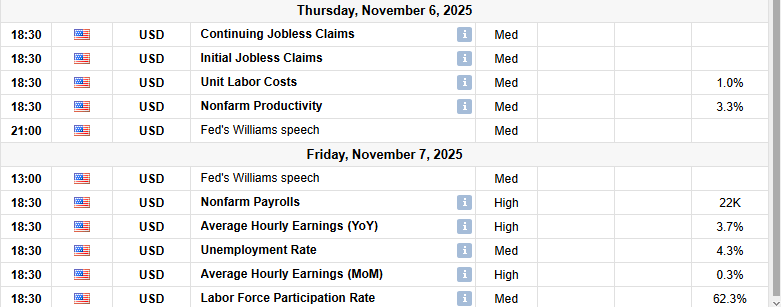

- USD Nonfarm Payrolls

- USD Average Hourly Earnings (YoY)

- USD Average Hourly Earnings (MoM)

Next week, traders await the Fed’s Daly speech, the ISM manufacturing PMI, and the RBA interest rate decision with a statement. The central bank is expected to hold the rates. So, the focus will be on the policy statement.

On the other hand, the nonfarm payrolls data remains the primary catalyst for the markets, as the markets missed the previous data amid the shutdown.

AUD/USD Weekly Technical Forecast: Wobbling Around Key MAs

The AUD/USD price consolidates near 0.6550, after brief gains around 0.6620 earlier in the week. The price stays below the confluence of 20-day and 100-day MAs around 0.6530. However, the 200-day MA at 0.6440 continues to lend moderate support. Meanwhile, the RSI around the 50.0 level indicates a neutral momentum.

-Are you interested in learning about the forex indicators? Click here for details-

A decisive breach above the 0.6615 level could ignite an uptrend, marching towards 0.6670 and 0.6730. Conversely, a break below the 0.6530 level could trigger further downside towards 0.6440 and 0.6380, inviting broader selling pressure.

Support Levels

Resistance Levels

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.