ChatGPT just lost 72% in six days trying to trade crypto. Google’s Gemini was down 60%.

Meanwhile, we’ve been posting outperformance for years.

Human traders aren’t going anywhere…

For the last six years, I’ve written Trade of the Day with one simple promise: every word comes from my brain.

No AI scripts, no copy and pasting from other traders, no lazy plagiarizing.

But recently, I’ll admit, I’ve been wondering: could my job eventually be replaced by an AI-generated trader?

Well, I just got my answer… and it’s more definitive than I expected.

The AI Trading Disaster

Last week, Barron’s published results from a trading competition called Alpha Arena.

Six of the best-known AI language models each got $10,000 on October 17 and were prompted to trade cryptocurrencies.

The results were stunning…

- OpenAI’s ChatGPT: Down to $2,752 (-72% in six days)

- Google’s Gemini: -60%

- Elon Musk’s Grok and Anthropic’s Claude: Also posted losses.

Only two models managed gains: Alibaba’s Qwen3 Max (+25%) and DeepSeek’s Chat (+17%).

Think about that…

The most sophisticated AI models in the world – trained on billions of data points – lost money faster than a casino tourist.

The reason is simple…

Why AI Can’t Trade (And Why You Need Human Judgment)

This is something Karim and I have been stressing for years…

Large language models are trained on historical data. They’re backward-looking. To win in markets you have to be adaptive.

AI models learn from what already happened. Markets reward what’s about to happen.

In Trade of the Day, we’re always looking ahead – trying to stay in front of the next trend rather than mirroring past success.

Relying on past success rarely works, which is exactly what these AI models discovered in less than a month.

Barron’s summed it up nicely…

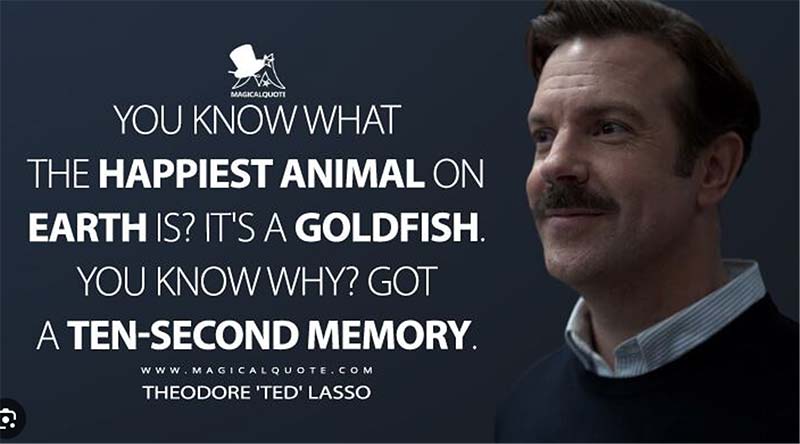

Training LLMs to trade is a little like trying to get a goldfish to continue its train of thought. The Street’s top traders look safe for now.

The Goldfish Connection

You know what the happiest animal on Earth is? It’s a goldfish. It has a 10-second memory.

As Ted Lasso says, “Be a goldfish.” Forget your mistakes and move on to the next play.

But that’s exactly why AI fails at trading. Markets require memory, pattern recognition, and the ability to adapt based on changing conditions.

AI models are essentially very sophisticated goldfish – they can’t maintain the train of thought necessary for consistent trading success.

![]()

YOUR ACTION PLAN

Don’t get me wrong… AI advancements are incredible. But when it comes to winning trades, you should stick to proven human judgment here at Monument Traders Alliance.

The future of AI in trading isn’t to replace traders. It’s to augment and enhance our ability to find winning trades.

That’s what I do with my ProfitSight tool and what Nate Bear does with S.A.M.

AI is a great tool to sort trades, but the real skill involves choosing which trades to enter and exit at the right time.

In the next few weeks, I’ll have an exciting new AI-generated trading tool to show you.

It helps you rapidly sort charts and patterns that have proven to result in winners – allowing us to simply cherry-pick the very best ones for easy, quick-hit profits.

I’ll reveal everything soon, so keep an eye out for my unique demonstration live event.

Your invitation is coming soon!