There’s a saying in trading that goes…

“If you’re hearing the news, the move’s already priced in.”

Case in point…

Last week, Scott Bessent told CNBC that the U.S. government has been targeting several sectors over the last few months for equity stakes.

Semiconductors…

Shipbuilding…

Rare earth minerals…

All of these sectors are on the table for Uncle Sam. [AH1]

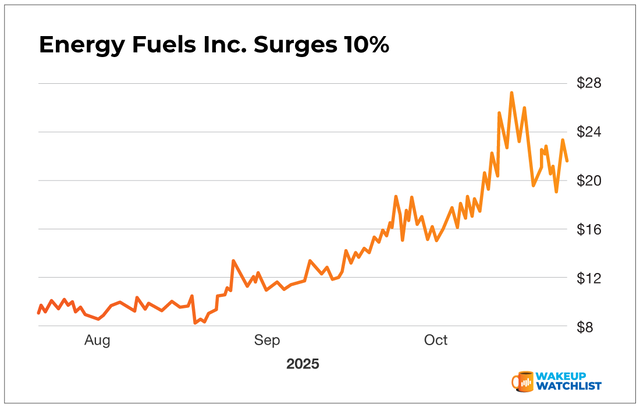

While there are many companies ripe for government investment… one candidate I like is Energy Fuels Inc. (UUUU) the most.

UUUU is a rare earth mineral company I’ve been tracking for weeks… well before Bessent’s remarks. I also mentioned it during our “Uncle Sam’s Ultimate Shopping Spree Event” yesterday.

Almost on cue, the stock shot up.

The move was driven by rare-earth and critical-minerals tailwinds.

The truth is… it’s impossible to predict exactly when these moves on “government equity” companies will happen.

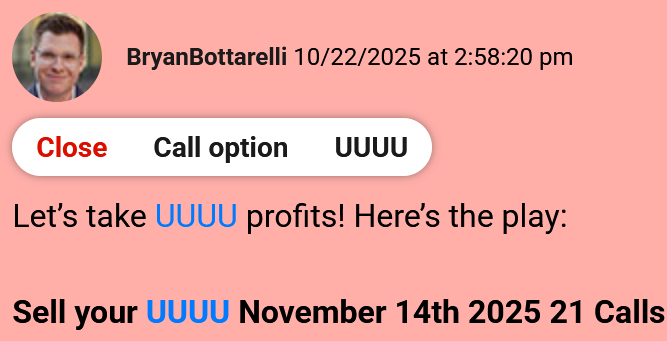

But because I was aware of the expectations early on, I got positioned on UUUU before the news broke. The result was a 24% winner.

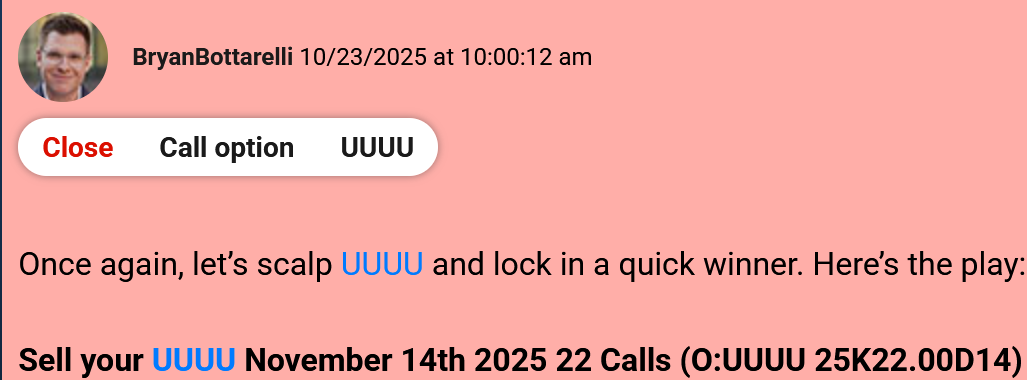

Then, the next morning I reloaded on UUUU and closed another 10% gain in 15 minutes.

That’s how I’m trading these “government equity” companies.

I’m not buying and holding a stock for 20 years.

I’m getting in… and getting out.

A few War Room members are already seeing the results from this strategy.

Here’s what some of them had to say…

I believe this is just the start of multiple buy opportunities on companies like UUUU.

Over the next few months, the government will be looking to add more stakes in companies as it competes with China to become the No. 1 AI provider in the world.

To do that, it’ll be looking at strategic resources like rare earths and other critical minerals to fuel the AI race.

UUUU checks those boxes.

Action Plan: The multiple wins I took on UUUU this week are just one example of how I’m playing these “government equity” stocks going forward.

If you want to follow more of these plays in real-time, you can join The War Room below.

Click here to become part of our elite trading community today.