Editor’s Note: Inflation isn’t going away anytime soon. But as Oxford Club’s Chief Income Strategist Marc Lichtenfeld explains, one asset class has beaten inflation for nearly a century – small cap stocks.

And in today’s guest article, Marc says a select group of these small companies could deliver the biggest gains of our lifetimes.

This week Marc and Chief Investment Strategist Alexander Green hosted The Micro Mag 7 Summit, where they revealed seven tiny stocks that are poised to soar as America launches the largest AI buildout in history.

These small caps could hand early investors 1,500% or more in the next year.

– Ryan Fitzwater, Publisher

Inflation may have slowed down, but no one is celebrating. At 2.9%, it remains well above the Fed’s 2% target.

And with more interest rate cuts and higher tariffs likely coming, I expect inflation to accelerate.

Fortunately, there’s an asset class that has absolutely crushed inflation every decade for nearly a century. And I bet you’ll be surprised when you find out what it is.

It is not gold.

Gold has kept up with inflation over the very long term, but that’s about it. An ounce of gold essentially buys the same amount of goods and services today as it did a millennium or two ago.

The big inflation beater is small cap stocks.

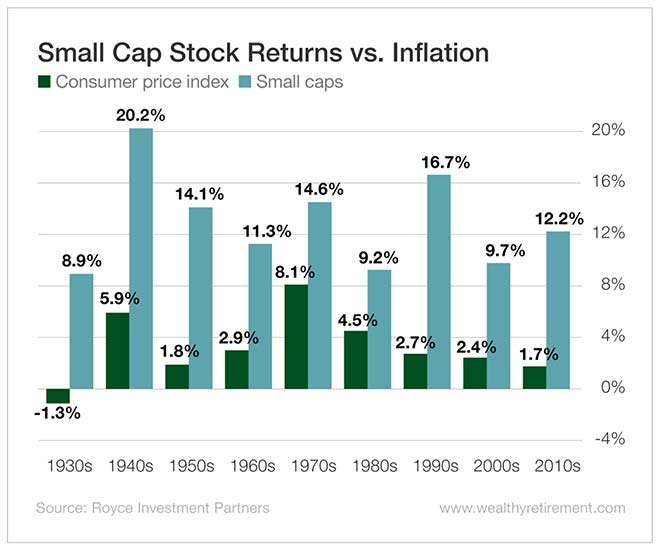

You can see from the chart above that small caps strongly outpaced inflation in every decade. The smallest margin was 4.7% in the 1980s.

On average, small caps returned 13% annually, while inflation averaged 3.2% – meaning small caps increased an investor’s buying power by an astounding 10% per year.

That doesn’t just mean you could have had 10% more money each year. It means you could have bought 10% more goods and services each year – no matter how high prices rose during that year.

To make it clear just how profound this is, let me give you an example. Let’s say you’re a golfer and the average round of golf costs you $100. You have a budget of $1,000 per year for golf (not including equipment). That means you can play 10 times per year.

But now imagine that, due to inflation, a round of golf will cost you $105 next year. If your budget doesn’t increase, you’re down to playing nine times per year. And in a few years, if inflation remains constant, that will decline to eight times.

But now imagine that you added the average yearly return (13%) that small caps have delivered to your golf budget, increasing it from $1,000 to $1,130. Not only would you be able to afford the annual bump in greens fees, but you’d also be able to increase the number of times you can hit the links to 11 per year. You’d be able to play 12 times the following year… and so on.

Small caps get a bad rap. Many investors think they’re super risky. And certain ones are. There are plenty of garbage companies out there.

But as an asset class, small caps have a fantastic track record that goes back decades. And surprisingly, they help investors increase their buying power even during periods of high inflation.

Going forward, it will be important to have small caps in your portfolio. With large caps trading at historically high valuations (and with more rate cuts by the Fed on the horizon), they are likely to be the top performers in the near term.

Many people think of small caps as speculative investments. But they have proven over nearly 100 years to play a vital role in allowing investors to beat inflation and increase their buying power.

![]()

YOUR ACTION PLAN

But now, there’s an entirely new presentation that details the new wave of tiny stocks that could soar. It’s called the Micro Mag 7. I hosted the live event with Alexander Green to inform Members.

Good investing,

Marc

FUN FACT FRIDAY

Corporate earnings start strong: Despite jittery markets, about 86% of the first 130 firms in the S&P 500 have beat expectations. The markets are also hitting new highs thanks to a softer-than-expected inflation print.