Much like technology, gases, too, are in the middle of a transformation—from older, high-emission compounds to more sustainable and climate-compliant alternatives. The industry is moving away from chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), often called “sunset gases,” towards a new generation of refrigerants known as hydrofluoroolefins (HFOs), or “sunrise gases.” These have zero ozone depletion potential and significantly lower global warming potential, aligning with India’s climate goals.

The Indian fluorochemicals and specialty gases market is projected to grow at a robust 16-18% CAGR between 2024 and 2029, driven by demand from electronics, semiconductors, and automobiles. Within this fast-expanding space, four companies—SRF, Gujarat Fluorochemicals, Navin Fluorine, and Stallion—command nearly 78% of the market, with Stallion holding around 10%.

What makes Stallion different

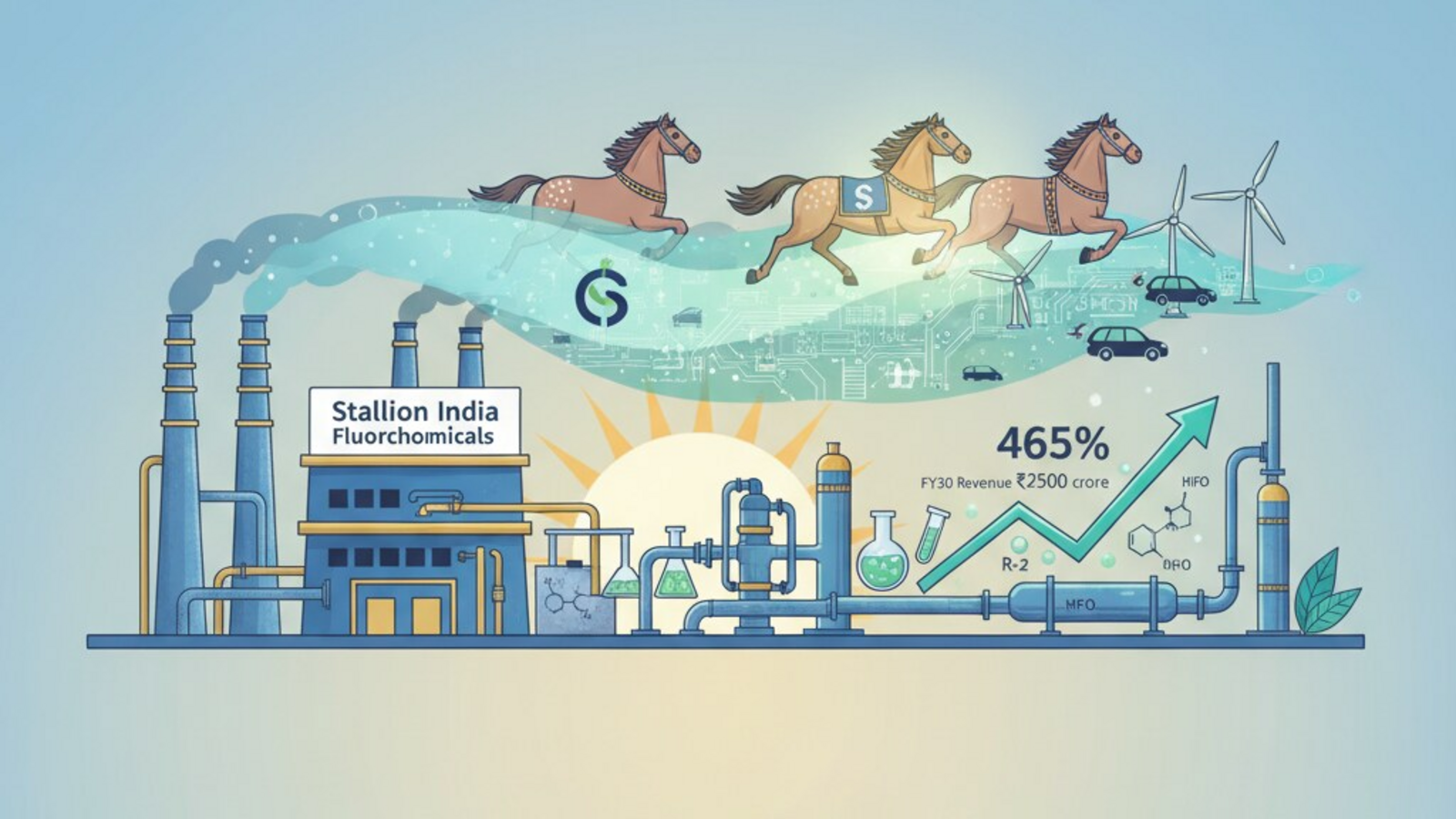

Stallion India Fluorochemicals is a specialized provider of refrigerants and industrial gases. It operates in the critical segment of gas debulking, blending, and processing — importing molecules, purifying them, and filling them into cylinders. While it doesn’t yet manufacture base molecules, its operations cover over 40 gases across 15 industries, from automotive and pharma to defence and solar power.

Nearly 60% of Stallion’s portfolio is multi-use, meaning the same gas can act as a refrigerant, blowing agent, or propellant depending on purity. Its facilities in Khalapur, Ghiloth, Manesar, and Panvel give it a strong pan-India footprint, and the company claims to have maintained zero supply disruptions even during global shortages. With a 10% domestic share, Stallion is now one of India’s leading organized refrigerant gas players.

Strategically, Stallion has focused on the aftermarket segment, which contributes about 80% of industry demand and offers far higher margins than OEM supply. Around 60-70% of its volumes serve this segment, providing steady cash flows and pricing power.

The drivers behind the rally

Investor optimism stems from Stallion’s aggressive forward and backward integration plans — moves that could make it the only Indian player with a fully integrated presence across the refrigerant value chain.

The company is doubling capacity with two new plants at Mambattu (Andhra Pradesh) and Khalapur (Maharashtra). The Mambattu facility, with an annual capacity of 7,200 metric tonnes, will anchor Stallion’s entry into HFOs and specialty gases — increasingly used in high-demand sectors such as data centres and semiconductors.

A crucial competitive edge lies in its patent access. Stallion is one of only two companies, alongside Chemours (formerly DuPont), authorized to sell HFOs in India through a long-standing partnership with Honeywell. No domestic HFC manufacturer can produce or sell HFOs until this patent expires.

The Mambattu plant will also handle helium and semiconductor gases, mirroring Khalapur’s upgraded operations. Once complete, Khalapur will process 1,200 metric tonnes of liquid helium annually, placing Stallion among the few Indian suppliers in this niche segment. The company has also raised its cylinder gas-filling standard from 200 bar to 300 bar, enabling 50% more gas per cylinder — a benchmark currently met only by Linde in India.

Backward integration into manufacturing

Already forward-integrated across distribution, blending, and packing, Stallion now aims to move upstream. It has signed an MoU with the Rajasthan government to build a 10,000-tonne R-32 refrigerant manufacturing facility in Bhilwara, with an investment exceeding ₹200 crore. Production is expected to begin by July 2026, potentially generating ₹500-700 crore in annual revenue at full capacity.

The plant will produce R-32—a key input in next-generation, low-global-warming-potential refrigerants—along with blends such as 410A, 404A, 454B, and 513A. Stallion also plans to add anhydrous hydrogen fluoride and methylene chloride to its portfolio within the next 18 months.

Financials underscore the growth story

In the first half of FY26, revenue surged 52% year-on-year to ₹216 crore, driven by higher volumes and a richer product mix. Ebitda margin rose 320 basis points to 13.9%, while PAT jumped 144% to ₹22 crore. Management is confident of meeting its full-year revenue guidance of ₹430 crore (up from ₹377 crore in FY25), with incremental contributions of ₹100 crore expected in FY26 and FY27 from new facilities.

Looking ahead, Stallion expects revenue to rise sixfold to ₹2,500 crore by FY30, powered by capacity expansion, specialty gas diversification, and operating leverage.

Fully integrated operations and entry into manufacturing (22–24% PAT margin) and specialty gases (16–20% PAT margin) could lift blended margins by 800 basis points to 17–18%, while RoCE and RoE improve from FY25 levels of 16% and 10.8%, respectively.

For more such analysis, read Profit Pulse.

Valuations: priced for perfection

Stallion’s expansion story has led to a sharp valuation rerating—from a P/E of 16x to 74x, now in line with Gujarat Fluorochemicals (66x) and Navin Fluorochemicals (74x). While valuations appear full, the stock’s trajectory will hinge on execution, particularly how effectively the company delivers on its ambitious integration and capacity plans.

About the author: Madhvendra has over seven years of experience in equity markets and writes detailed research articles on listed Indian companies, sectoral trends, and macroeconomic developments.

Disclaimer: The writer does not hold the stocks discussed in this article.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.