Two weeks ago, a gentlemen got me fired up during our Catalyst Cashouts livestream.

We were talking about some of our recent winners.

Then I saw someone type something in the chat along the lines of…

“What about your such-and-such play that’s down?”

This person was referring to a long-term crypto play we were positioned on.

I was like…

Dude, get a life.

How negative is your life if all you think about is things that are down?

We got a two-year play here, and you’re worried about it – you shouldn’t be in it.

Flash forward to two weeks later.

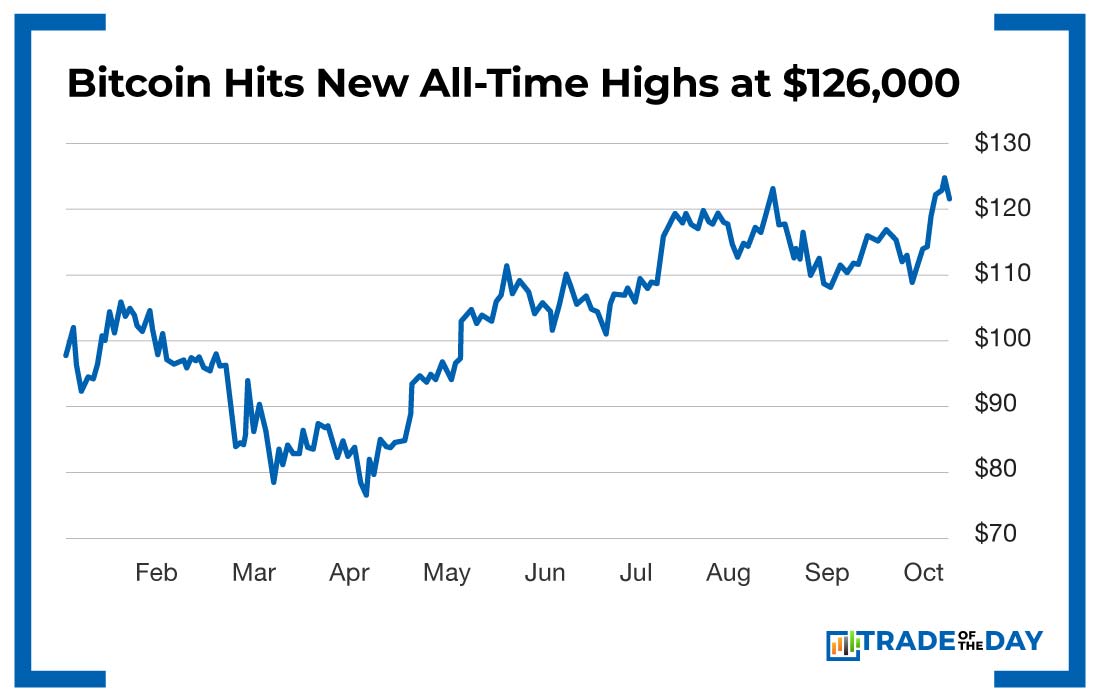

Bitcoin hit new all-time highs of $126,000.

Overall, Bitcoin is up about 8% overall since we got in, and the current play is up 16%.

I don’t mention this to call anybody out or say “I told you so.”

I say this because it’s a good example of the ebb and flow of long-term trading.

Often times a trader will buy a stock, then panic sell it after a 10% dip.

But in this specific trade, I had a two-year window to take profits. So worrying about the play being down in the short-term is an incorrect mindset.

The truth is…

We’re always going to have some losing trades in our services.

Our current track record in The War Room is a 76% win rate since we started in 2019.

But just because a long-term play is down in the short-term, it doesn’t mean the overall trade is a loser.

Ok, enough about the downside of panic selling.

What about the upside of holding?

Well, as we continue to hold onto this crypto play, I want to show you why I believe it still has room to grow.

Right now, analysts at JPMorgan are predicting $165,000 Bitcoin by the end of this year.

If Bitcoin reaches $165,000 or even $200,000, then this long-term crypto play could be a double or even a triple.

When it comes to trading crypto itself, Bryan and I have always been skeptical.

We’re not out here shilling memecoins with nothing tangible backing them.

We’re also not ignoring risk management.

Crypto is a volatile market that moves fast – and a small mistake can nuke everything.

Just like with our options trades, we’re establishing clear entry and exit plans.

We’re also using stop losses and position sizing to manage risk.

These fundamentals are the essence of consistent winning trading.

So if you ever get worried about a long-term play being down, remember to focus on these fundamentals so you know you’re trading without unnecessary risk.

![]()

YOUR ACTION PLAN

In case you missed yesterday’s Cashouts livestream, we announced another long-term trade alert on Anixa (ANIX), with a catalyst that could be announced on December 11, 2025.

Click here to login and get that trade.