India will be the swing factor for the new sugar season, which began on October 1, with a likely surplus of 7 million tonnes (mt) in sugar production, industry analysts and experts say.

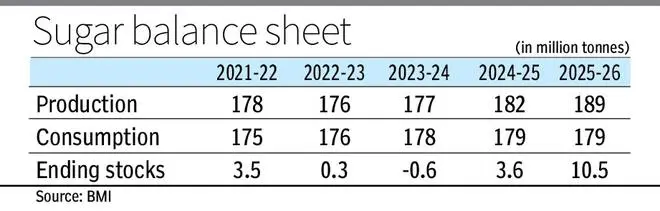

However, research agency BMI, a unit of Fitch Solutions, said better-than-expected output in Brazil, a sharp upturn in Indian production, and weaker crude prices have contributed to an increasingly bearish sentiment through Q3 2025.

Analysts at Uruguayan Commodities Media Monitoring group ECRUU’s sugar week said the Indian government may decide to resume sugar exports between January and February, depending on the supply-demand situation.

Export estimates

According to Green Pool Commodity Specialists director Tom McNeill, India’s 7 million tonnes (mt) sugar surplus in the 2025-26 season will be divided between meeting demand for ethanol and exports.” It sees 4.5 mt of the surplus from the gross production of 35.9 mt production being diverted for ethanol, while exports could be between 1 mt and 2 mt.

Claudiu Covrig of Covrig Analytics said the Indian government may not allow more than 1.8 mt to 2 mt of sugar for exports. Carlos Murilo Barros de Mello, head of sugar and ethanol at Hedgepoint of US, projected 1.5 mt of sugar exports from India.

“The (Indian) Government’s decision on exports will be based on its own estimates of sugar production. If the Government’s estimates of production are low, then we may have to wait until January-February for the export decision,” said Kiran Wadhwani, Director, Comdex India, in an interaction at the ECRUU sugar week.

India could decide on permitting sugar exports as early as December and as late as February, said Covrig. Global surplus sugar will be locked in India, he said.

ISMA projections

BMI, in its outlook issued separately, said India’s participation in the global sugar market is expected to increase, reversing the recent trend of low export volumes that contributed to tighter global supplies last season.

Private sugar mills body Indian Sugar and Bio-Energy Manufacturers Association (ISMA) has initially pegged gross sugar production at 34.9 million tonnes (mt), up 18 per cent compared with 29.5 mt last season. It expects 5 mt of sugar to be diverted for ethanol production. It has urged the Government to permit 2 mt of exports.

BMI estimates Indian production at 35.3 mt, even as it expects Brazil to produce 43.7 mt.

Wadhwani projected sugar consumption in India to rise to 28.5 mt this season. “If there is more sugar in the pipeline, then consumption could rise by another 0.5 mt,” he said.

Price outlook

de Mello said the sugar outlook was favourable for India and Thailand. With the next crop in Brazil likely to be good, there is no reason for sugar prices to rise for a year or so, he said, adding raw sugar prices could remain stable around 16 US cents a pound.

BMI lowered its average annual price forecast for front-month ICE-listed sugar futures to 17.5 cents, down from its previous projection of 18 cents a pound. “We expect prices to average around 16–17 cents a pound for the remainder of 2025,” it said.

The research agency said that the Commodity Futures Trading Commission’s latest report, dated September 23, indicated that money managers hold a net short position of 151,598 contracts in ICE-listed sugar futures, up from 85,592 contracts at the end of the second quarter this year.

Projecting India’s consumption at 28.8 mt, Green Pool said Indian sugar mills would look to export as domestic prices are lower. “The Indian government is under pressure to increase the minimum selling price for sugar,” said Green Pool’s McNeill.

3rd largest global surplus

Wadhwani said mills in Maharashtra and Karnataka could divert sugar for ethanol production if domestic prices fall. Though ISMA has sought a hike in ethanol price, it does not expect it to increase.

Analysts at the ECRUU Sugar Week estimated that the global sugar market will likely witness its third-largest surplus in the 2025-26 season, with India and Thailand playing a significant role.

Green Pool said the Asia-Pacific market, in particular, holds the key to the global sugar market in the current season.

Thailand’s production is estimated to rise to 11.35 mt, and it is expected to export 7.6 mt, it said, adding that though the weather is favourable for sugar production in Thailand, the plants are being threatened by the white leaf disease.

Chinese imports

China is expected to produce 11 mt of sugar, with lower prices in New York spurring imports. Raw sugar imports could be 4.7 mt, while white sugar imports may be 400,000 tonnes. In addition, syrups and mixes import could be 100,000 tonnes.

Australia, too, is expected to witness a good production of 3.9 mt. Of this, 3.2 mt will likely be exported. Pakistan is projected to produce 6.25 mt of sugar, but it will continue to import. Bangladesh will be out in the global market to import 2.5 mt, said Green Pool.

Among other countries, Indonesia is expected to import 5.9 mt and South Korea 1.76 mt.

Published on October 8, 2025