Editor’s Note: Back in May, legendary investor JC Parets warned our readers to IGNORE the mainstream’s market crash narrative.

Since then, the S&P has reached new all-time highs, and the 1% who listened to JC took advantage.

Now, he’s just detected the next opportunity to target up to 2000%+ returns over the next few weeks.

It’s part of his “zero hour” briefing, and you’re invited to join him live on Wednesday, Oct. 8 at 2 p.m. ET.

Don’t miss the next pivot point in the markets.

Ryan Fitzwater, Publisher

When it comes to trading in October after a rate cut, the numbers don’t lie.

Dating back to 1973, the S&P has averaged a -1.1% return 3 months after the first rate cut.

So going forward, I’m taking a more defensive approach.

One defensive play I’m watching right now is Costco (COST).

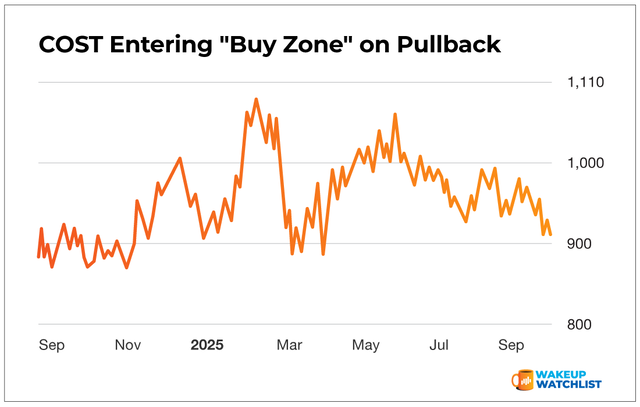

As you’ll see in the chart below, shares of COST dipped 1% despite a recent fourth-quarter earnings beat and revenue topping Wall Street estimates.

Despite the modest dip, I believe we’re in the buy zone for COST.

Rate cuts have been historically good for consumer staples like COST – a company that benefits from a loyal following that’s consistently growing its membership count.

Now, as COST hits a key $900 support level, I’m looking for a bounce.

Action Plan: COST is entering a key “dip buy” zone on a pullback, and I’ll be looking to get positioned in The War Room.

For more trade ideas like this, I recently unveiled my latest $3 play in Catalyst Cashouts.

But this isn’t a stock – it’s actually a cryptocurrency.

I believe this crypto could surge to $92 by the end of next year.

You can learn exactly why I’m so excited about this rare opportunity by clicking below.