Ever since the FOMC cut interest rates in September, we’ve been watching the healthcare sector for trades in The War Room.

We’ve already cashed one winner this week.

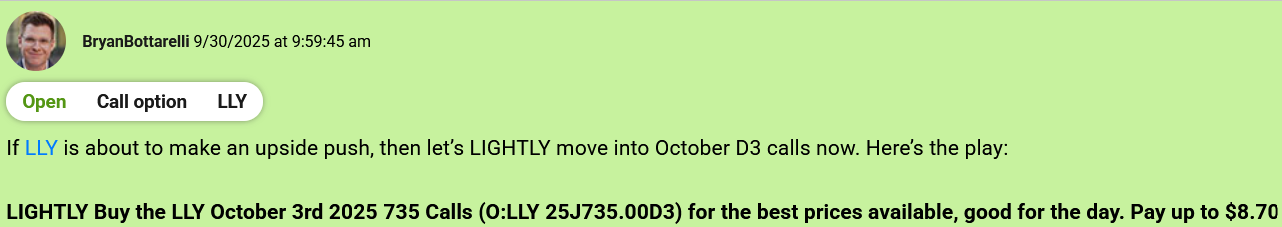

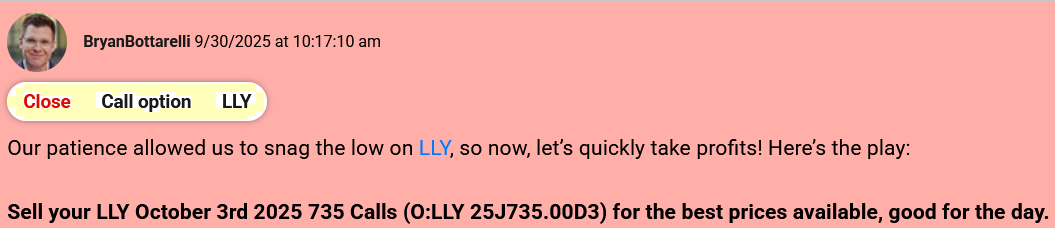

Yesterday, my colleague Bryan Bottarelli closed a 20% gain on pharma group Eli Lilly and Company (LLY) in less than 30 minutes.

The move came after President Trump announced a 100% tariff on branded drugs imported into the U.S., benefitting companies like LLY.

Here’s what a few War Room members had to say about the LLY trade…

While this is a strong start for healthcare stocks post-FOMC, I believe it’s just the beginning.

I’m currently tracking a long-term trade opportunity on a company that could benefit from a major government health initiative.

Here’s the breakdown…

Yesterday, the White House announced a plan for a direct-to-consumer website for Americans to buy drugs, dubbed TrumpRx.

TrumpRx would allow people to pay cash for certain drugs directly from a government website, at a discounted price negotiated by the government.

But that’s not all.

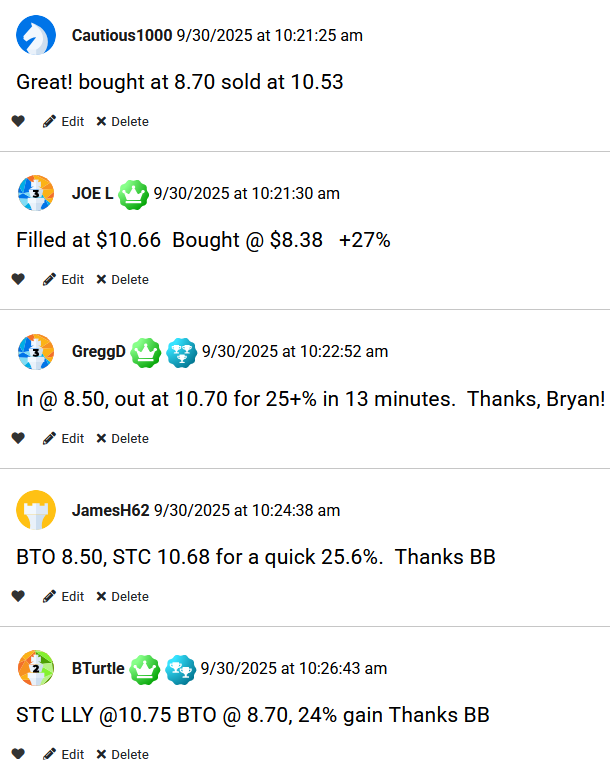

It also announced that pharma group Pfizer (PFE) is planning to lower prices on several of its medications in the U.S.

It’s unclear how many drugs would be offered.

But overall, Pfizer is expected to be the first to announce a plan to lower drug costs after President Trump pushed companies for months to lower prices in the U.S.

Albert Bourla, the chief executive of Pfizer, announced the cost-cutting measure at the White House yesterday.

He also announced a $70 billion investment on manufacturing medications in the United States.

This news could be big for PFE.

It’s why it’s one of my top watchlist stocks for a potential long-term play this week.

Action Plan: With Pfizer’s latest announcement to lower drug prices and Trump’s new TrumpRx initiative, I believe it’s a long-term trade candidate right now.

To see exactly how I’m playing this news, I invite you to join Bryan and I in The War Room. Last month, we closed 79% of our trades for winners. And after the Fed’s latest interest rate cuts, I believe we could see more buy opportunities over the next 90 days.