A few weeks ago, I showed traders 5 sectors that could be on the verge of taking off during the Fed Shockwave.

One of those sectors was healthcare.

The truth is… interest rate cuts have historically led to gains in the health sector.

When the fed cuts rats, companies can borrow money easier, and healthcare companies use that money to fund research for projects that could lead to the next breakthrough drug.

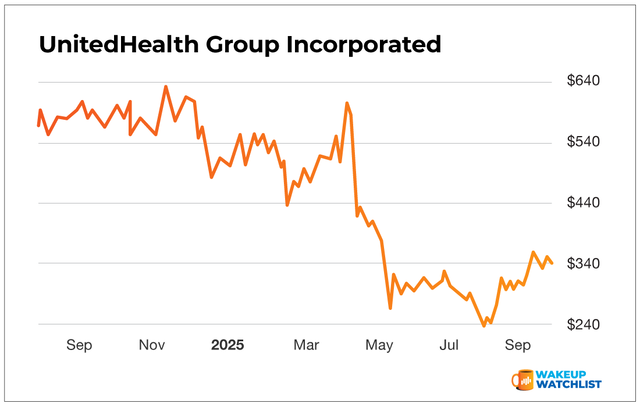

One healthcare company I’m watching for a trade this week is United Health Services (UNH).

A few reasons why…

Warren Buffett recently purchased $1.6 billion worth of shares in the last quarter of 2025.

Any time one of the world’s greatest investors makes a purchase that big – I take notice.

Healthcare has also been one of the worst performing sectors in the S&P 500 this year, with valuations at 17x forward earnings (versus the broader market which stands at 22x).

In terms of UHS stock, its down 31% this year. I think this is “buy the dip” time, with the rate cuts serving as a catalyst.

Action Plan: UNH is just one of several healthcare companies I’m tracking during this post-FOMC shockwave in The War Room.

I’ve already traded several health stocks for winners in recent weeks. Last week I closed a 32.63% winner on CVS in 1 trading day.

Don’t let anybody tell you the latest FOMC rate cut isn’t a golden opportunity for traders.

Sign up below and receive all our post-FOMC trade alerts today.