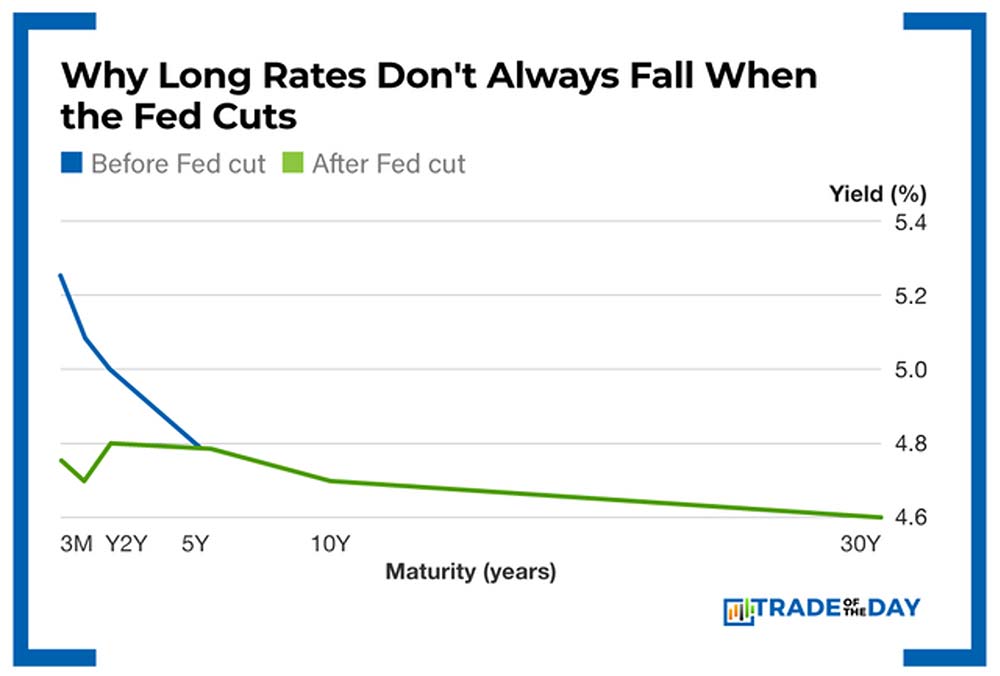

After the FOMC’s recent 25 basis point cut in interest rates, many people thought all interest rates would fall.

Imagine their surprise when the long-term rates actually moved higher.

What gives?

Well, the truth is… the Fed only directly controls the short end of the curve (overnight rates, fed funds, etc.). While long-term interest rates (like the 10-year or 30-year Treasury) are set by the market based on future expectations.

Here’s why long-term rates don’t always fall when the Fed cuts:

Inflation Expectations

If markets think Fed cuts will stimulate growth or stoke inflation, investors may demand higher yields on long-term bonds to compensate for the erosion of purchasing power. So, if the Fed cuts into an already hot economy, long rates can even rise.

Term Premium

Long rates embed a risk premium for holding long bonds (uncertainty about inflation, fiscal deficits, supply of Treasuries). If deficits are large or Treasury supply is heavy, long rates may stay elevated regardless of Fed cuts.

Growth Outlook

If Fed cuts are seen as too late or a sign of economic trouble, long yields may drop (flight to safety). But if cuts are interpreted as insurance cuts (to keep the economy humming), long rates may not fall—or may rise—because growth is expected to hold up.

Global Demand for Treasuries

Foreign central banks, pensions, and investors buy long bonds. If demand weakens (say, due to better yields elsewhere or foreign exchange concerns), long rates resist moving down.

Market’s View of Fed Credibility

There’s also been a lot of action in the Fed “bench” this year from allegations of bad faith to conflicts of interest between the White House and the Fed.

And, If investors think the Fed is falling behind the curve on inflation, they may keep pushing long rates higher, even as the Fed trims short rates.

Here’s the yield curve sketch below: notice how the short end drops after the Fed cut, but the long end barely moves.

That’s because long-term yields depend more on inflation, growth expectations, and risk premiums than on the Fed’s immediate action.

Understanding how interest rates and the bond markets work is critical to investing the in the stock market. It’s part of our daily analysis in The War Room.

![]()

YOUR ACTION PLAN

While many traders might panic when the market surprises them, we actually have a way to create overnight gains as high as 157% when the market drops.