Editor’s Note: Last week, the Fed cut interest rates a quarter point, and the market responded with choppiness.

Now – the Shockwaves begin.

To make sure you’re prepared, our Head Trading Tactician Bryan Bottarelli is hosting a “Fed Shockwave” summit in just two days.

Here you’ll learn how Bryan plans to flip this volatility into BIG OVERNIGHT gains.

Don’t miss out on your chance to take advantage of this market chaos over the next 90 days.

Click here to sign up for this FREE Fed Shockwave event.

– Ryan Fitzwater, Publisher

If there’s one thing you must know about Wall Street, it’s this…

Wall Street overreacts – A LOT.

Any slight concern can send a company on a short-term downward spiral.

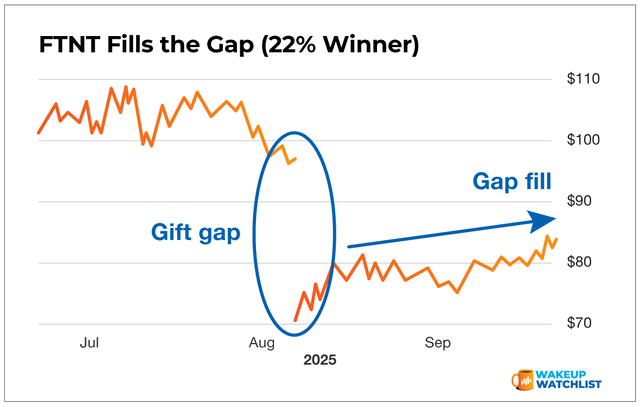

Take the cybersecurity company Fortinet (FTNT), for example.

Back in August, FTNT saw a near 30% drop in its price.

This dip stemmed from Wall Street concerns over FTNT’s latest firewall upgrade and how the upgrade failed to create a better financial outcome.

The move marked FTNT’s steepest one-day decline and its second-worst total decline ever.

Check out the down gap in the chart below.

While most traders would get anxiety over down moves like this – I considered it a gift.

This was classic Wall Street panic.

Shortly after the overreaction, FTNT started to fill its gap.

Once it filled the gap 10%, this was my trigger for a precise entry point.

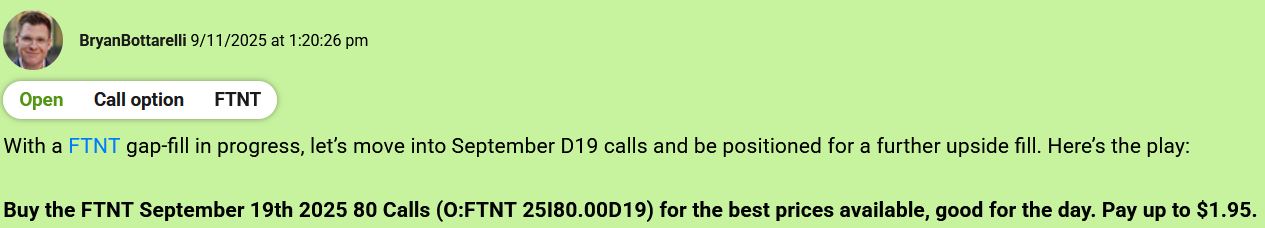

I got positioned in The War Room.

After I got in, I noticed the gap continued to fill, and if we could get up to $82.50 support price, then I there was more blue sky up to $95.

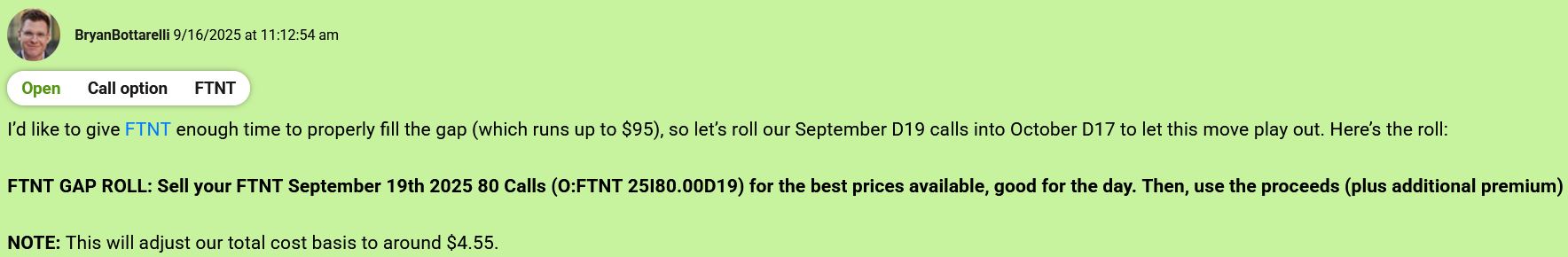

So I rolled the September FTNT calls over into October a few days later.

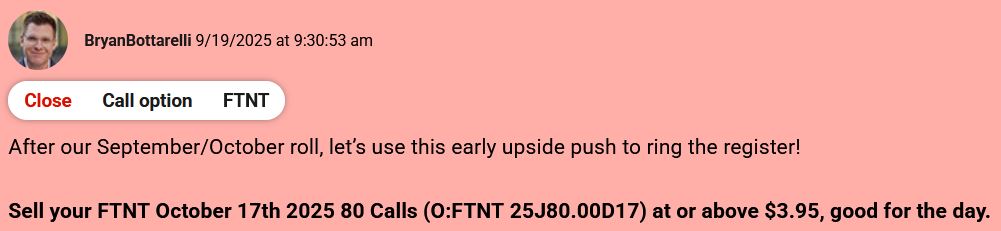

Eventually, we got one more push from FTNT into the profit soon, and I closed the trade for a 22% winner in 8 trading days.

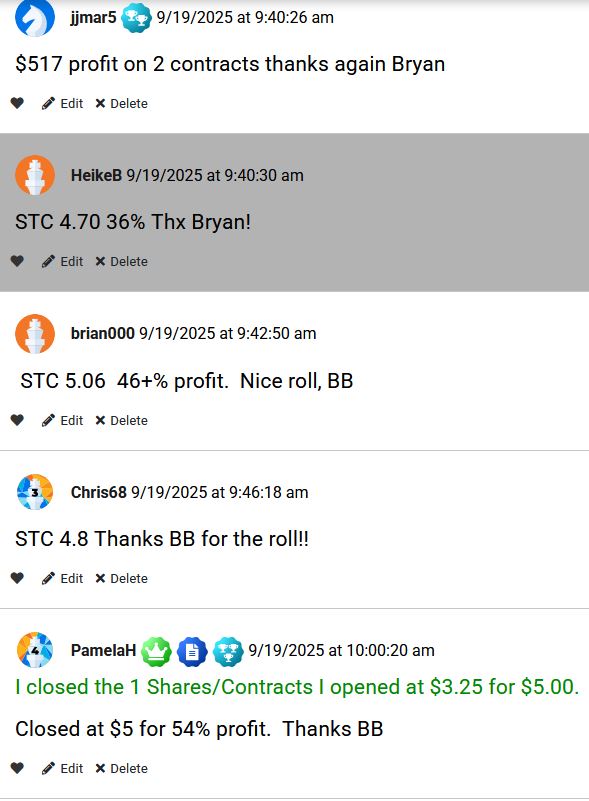

Several War Room members were in on the trade.

Here’s what they had to say…