**EDITOR’S NOTE: BIG ANNOUNCEMNT

***Fed Watch Party!**

This Wednesday, Karim and I are hosting a Fed Watch Party, so you can be with us for live reaction and commentary when the Fed announcement goes out.

This is the first time we’ve ever hosted a Fed Watch Party before, but since this September 17th announcement is so critical to the future direction of the markets, we wanted to give you the most transparent and real-time commentary possible.

So, be sure to join us live!

This Is A “Must Attend” Event, So Make Sure To Add It To Your Calendar Here:

T-minus two days…

The Fed vs. Trump showdown is finally here. We’re two days away from the most consequential Fed meeting in years.

You know the back-story…

Trump has been pressuring Powell to cut rates ever since he moved back into the White House.

And with the latest jobs numbers showing just 22,000 jobs were created in August…

A rate cut is all but certain.

As we go into this announcement, oddsmakers at CME FedWatch give a 94.7% chance of a quarter point cut and a 5.3% chance at a half-point cut.

Last Friday, I shared three scenarios for what could happen to the markets next.

In my “dream scenario”… I said Powell would cave to President Trump… begin a series of rate cuts… and the economy would boom.

While it might sound a little far-fetched given the current employment numbers and latest CPI numbers…

We’ve seen this dream scenario play out before…

Last year’s rate cut…

The last time there was a long period with no rate cuts was between July 2023 and September 2024.

And leading up to September 2024, economic conditions were similar to what they are today.

The economy was still expanding at a solid pace (the S&P had a strong 25.02% return that year), and the unemployment rate had moved up to 4%, was a modest increase from 3.8% in 2023. earlier. Inflation had also eased to 2.9% but remained somewhat elevated.

Despite the FOMC’s objective to get inflation down to 2%, in September they released a statement saying they were confident that its employment and inflation goals were roughly in balance.

So they lowered the target range for the federal funds rate by a half percentage point to 4.74% to 5% .

Stocks jumped immediately. The S&P 500 rose 1.7% the next day.

Small caps also outperformed, the dollar softened, and the Fed framed the move as gaining “greater confidence” inflation was headed to 2%.

Fast forward to a year later… and now there’s even greater pressure on the FOMC to start cutting aggressively.

But Trump is far from the first president to push on the Fed…

Presidential pressure from the past

In the 1960s, President Lyndon Johnson needed money to fund the Vietnam War and his Great Society programs.

He famously shoved Fed Chairman William Martin against a wall, saying “boys are dying in Vietnam and you don’t care.”

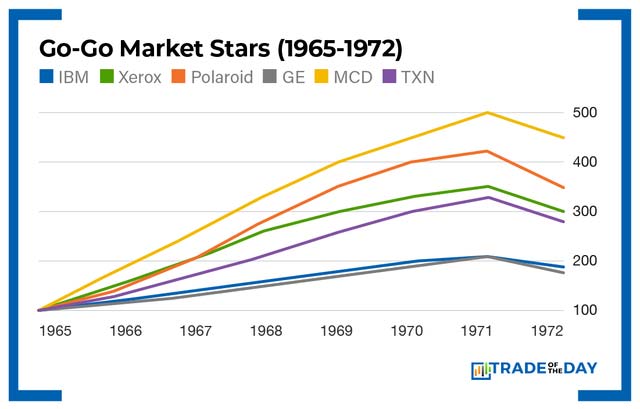

Martin caved and lowered rates. Employment dropped from 5% in 1964 to under 4% by 1966. Corporate profits also surged, with the go-go market of the late 1960s reflecting this.

Some industries that took off included tech stocks like IBM (IBM) and Xerox (XRX) and consumer fast food brand McDonalds (MCD). Other winners were General Electric (GE), Polaroid Cameras and Texas Instruments (TXN).

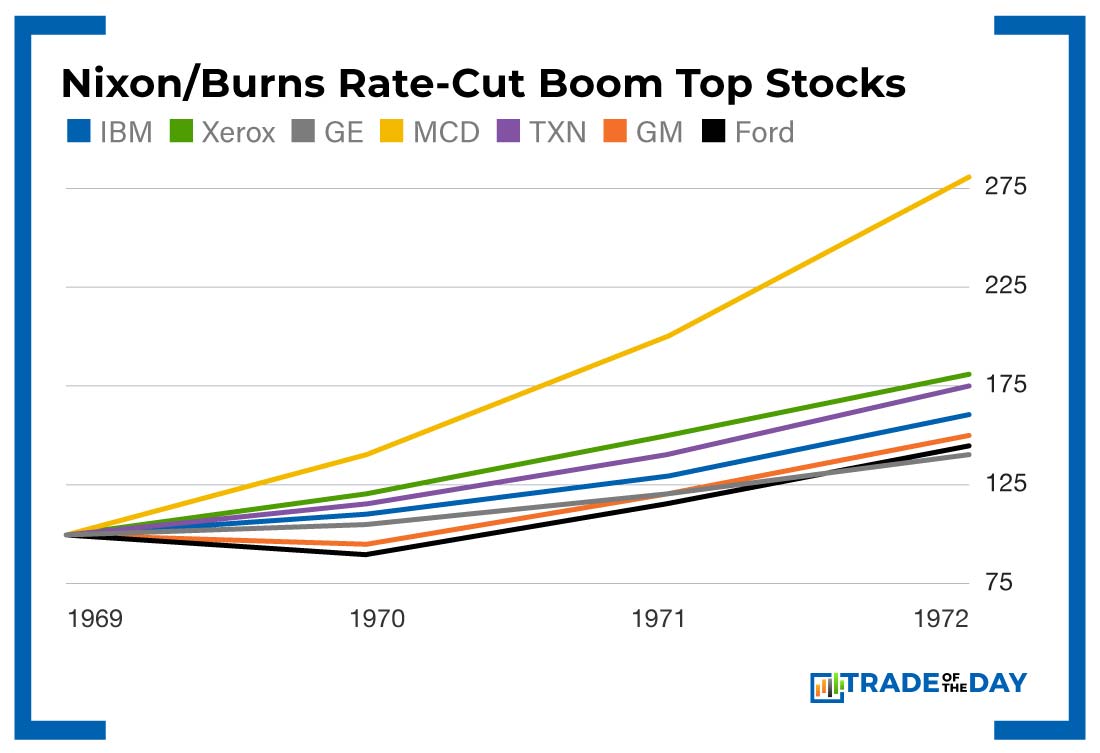

We saw something similar in the 1970s, That’s when President Nixon needed the economy strong heading into his 1972 re-election.

Nixon pressured the Fed Chair Arthur Burns to hold off on tightening despite inflation already rising in the 1960s. Recordings from the Nixon tapes show him pushing Burns to “do what’s right.”

So Burns caved and cut rates.

This led to a short-term economic boom, unemployment fell, and Nixon won in a landslide re-election in 1972.

Similar to the 1960s, consumer companies like McDonalds outperformed. The auto boom also led to companies like General Motors (GM), Ford (F) and Crysler benefitting from cheap financing.

However, both the 60s and 70s economic booms were also followed by painful inflation which led to recessions in the early and late 1970s. For example, inflation peaked around 11% in 1974 after the Nixon cuts.

The Dream Scenario: Long-term boom with no increase in inflation

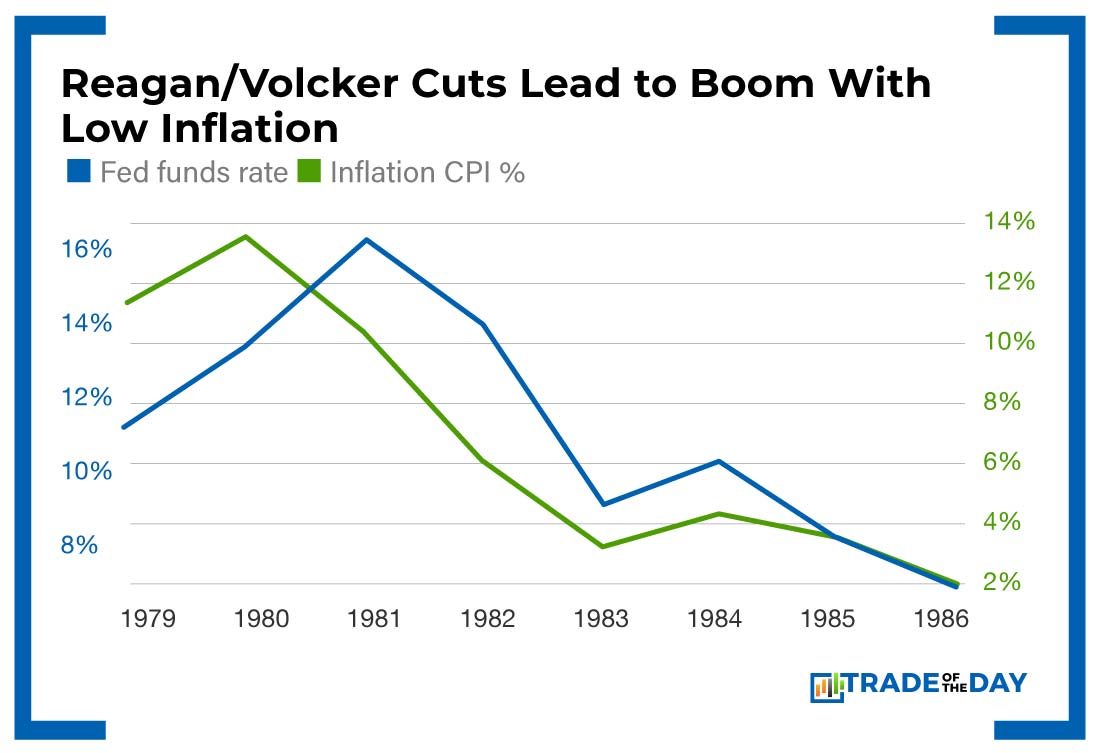

While inflation sometimes follows rate cuts, it wasn’t the case in the 1980s.

During Ronald Reagan’s era, the economy was dealing with painful 13-14% inflation in 1979-80.

To get inflation down, Fed-chair Paul Volcker raised interest rates up to 20% in 1980-81.

Reagan hated the move at the time, but he supported it with the idea that once inflation came down, the Fed would cut rates aggressively.

Which is exactly what happened.

When inflation finally hit below 4% in 1982-83, the Fed began slashing hard.

The fed funds rate dropped from 20% in 1981, to 9% in 1983, all the way down to 6% in 1986.

But unlike the 1960s and 70s, the 1980s cuts produced a long bull market.

The result was a 7% growth in GDP in 1984, one of the strongest years in modern history.

By the decade’s end, the Dow had tripled, and CPI generally ranged 2-4% through the rest of the decade.

Stocks that did well included tech groups like IBM, retailers like McDonald’s (MCD) and auto companies like General Motors (GM).

![]()

YOUR ACTION PLAN

No matter what Powell does, we’ll be helping you prepare for any shockwaves ahead.

On Wednesday, Karim and I will be hosting a FREE “Trump vs. Powell FOMC Watch Party.”

You’re invited to “be with us” for live reaction and commentary when the Fed announcement drops. This is the first time we’ve ever hosted a Fed Watch Party before, but since this September 17th announcement is so critical to the future direction of the markets, we wanted to give you the most transparent and real-time commentary possible.

So, be sure to join us live!

This Is A “Must Attend” Event, So Make Sure To Add It To Your Calendar Here: