Editor’s Note: One in six Americans still can’t get cell service.

But your iPhone already has the solution built inside.

Patent #11528076B1 reveals Apple designed technology that could eliminate dead zones entirely. They just haven’t activated it yet.

Alexander Green discovered why Apple is waiting – and why September 9th could change everything.

The missing piece? Apple needs something they can’t build themselves. Only one $3 billion company has it.

That’s why Apple quietly invested $1.5 billion in this firm.

While everyone’s chasing AI stocks at record highs, the real money will be made by companies that efficiently adopt AI without the massive R&D gambles.

Here’s why the smart adopters will crush the reckless builders…

Intel is worth LESS today than it was 26 years ago. Think about that.

During the dot-com boom, Intel was the golden child of the tech revolution. Investors couldn’t get enough.

Fast forward to today: Intel has massively underperformed while “boring” companies like Old Dominion Freight Line are up tens of thousands of percent.

The pattern is crystal clear – and it’s happening again with AI.

The Essential Point Everyone’s Missing

Sure, AI will eliminate millions of jobs and create privacy nightmares. It’ll also revolutionize healthcare, transportation, and education.

But here’s what matters for your portfolio: The biggest winners won’t be companies burning billions on unproven AI platforms.

They’ll be the smart adopters who efficiently integrate proven AI tools for immediate productivity gains.

History Doesn’t Repeat, But It Rhymes

Remember March 2000? Investors correctly predicted the internet would “change everything.” They bid leading internet stocks to unsustainable levels.

Result? The Nasdaq lost 75% of its value. Leading internet stocks dropped 90%.

The internet DID change everything. Every company moved operations online, cut middleman costs, and built e-commerce platforms. Companies that didn’t adapt disappeared.

But the investors who made fortunes weren’t holding the companies burning cash on uncertain tech development.

They owned the companies that efficiently adopted proven internet tools without massive R&D risks.

Three Categories of AI Plays

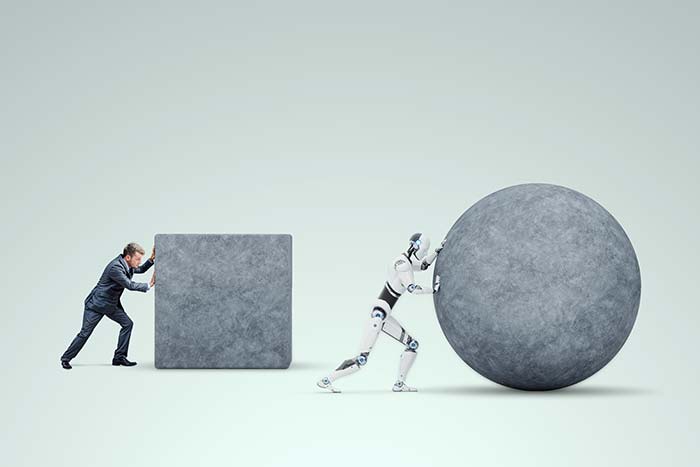

Reckless Builders: Companies gambling billions on unproven AI platforms with uncertain monetization paths. Many will see massive write-offs when innovations don’t pan out.

Smart Adopters: Banks automating loan processing. Manufacturers optimizing supply chains. Retailers personalizing customer experiences. Energy companies optimizing grid management. All using proven AI tools for immediate ROI.

Platform Winners: Companies like Apple that can leverage existing massive user bases to monetize AI development across established ecosystems.

The Rotation Is Already Starting

Most AI stocks aren’t as overpriced as internet stocks were in 2000. I don’t expect a complete crash.

But reckless builders will underperform as smart money rotates into efficient adopters and platform winners.

The difference? Smart adopters see immediate productivity gains with minimal risk. Platform winners monetize through existing customer relationships.

Your Strategic Advantage

While speculative AI builders trade at record highs, value opportunities are hiding in plain sight among smart adopters.

The upside is greater. The valuations are better. Much better. And the downside risk is far lower.

![]()

YOUR ACTION PLAN

Given this week’s market rotation signals, the high-growth/low-risk play isn’t the companies gambling on uncertain AI development.

It’s the efficient adopters and platform winners positioned for immediate AI benefits without massive R&D risks.

Position accordingly.

FUN FACT FRIDAY

Here’s a number that’ll blow your mind: 22,000.

That’s how many jobs the U.S. added in August. Economists expected 75,000. We got 22,000.

That’s not a “miss.” That’s an economic face-plant.

And it gets worse. Manufacturing lost 12,000 jobs for the fourth straight month. Unemployment hit 4.3%. The Fed is officially in panic mode.

Which is why September 17th changes everything.

That’s when Powell either saves the economy… or admits he can’t.

This isn’t just another data point. This is the weakest job growth since April 2020’s catastrophic 20.7 million job loss. The labor market’s pulse is fading fast.

We’re convinced this is the most pivotal Fed announcement in a decade. Which is why Karim and Bryan will be hosting a Live Fed Watch Party to break down exactly what this means for your positions.

Details coming soon…