Editor’s Note: The biggest Fed announcement in decades will happen on September 17th, and the impact this can have on the markets – and YOUR MONEY – could last weeks, months or even years to come.

Why?

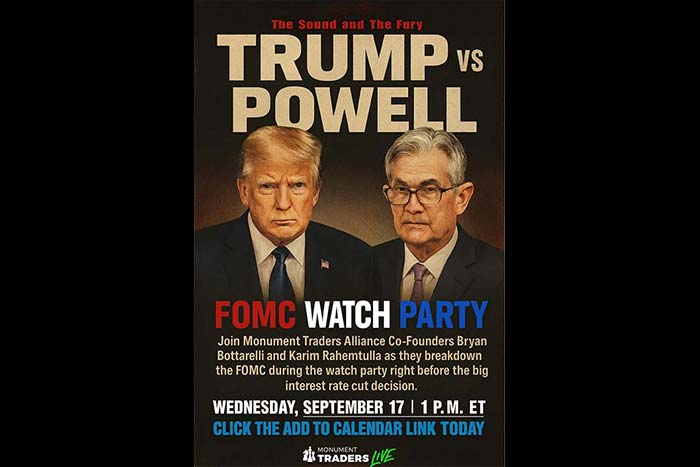

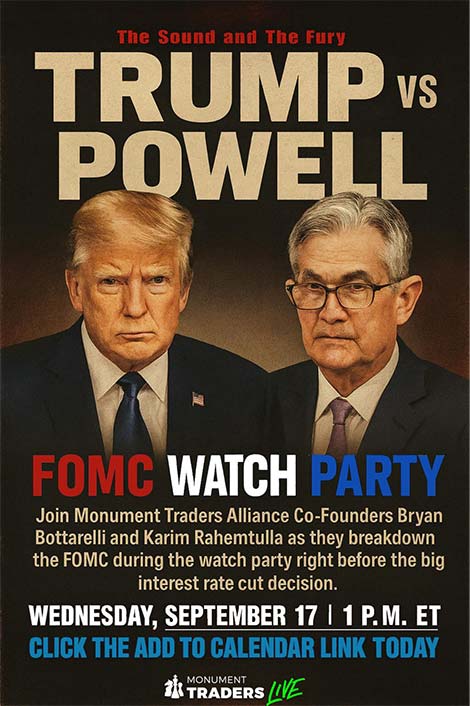

President Trump is squaring off with Fed Chairman Jerome Powell in (what could be) the last and final fight for control of the financial markets.

That’s why co-founders Bryan Bottarelli and Karim Rahemtulla are hosting a Trump vs. Powell FOMC Watch party on September 17 @ 1 p.m. ET (an hour before the announcement)… 100% FREE!

They’ll set the stage for the big Fed interest rate announcement – and what effects it will have on the markets and YOUR MONEY.

CLICK HERE TO ADD TO YOUR CALENDAR >>>

Do Not Miss It!

– Ryan Fitzwater, Publisher

As a warning…

Now that the calendar has officially turned from August to September, we’ve now entered a historically weak period for the major market averages.

September is usually the year’s most volatile month – simply because traders are starting to prepare for October – which has a reputation for the month that contains the largest market draw-downs.

Remember the Old Wall Street Adage! Stocks take the staircase up – but they take the elevator down.

It’s absolutely true.

So, as we start the first week in September, please be fully aware of the risks that are now right in front of you.

At the same time…

With the S&P 500 up +10.2% this year (following gains of 23% and 24% the previous 2 years), the current price-to-book ratio of the S&P now stands at 5.35.

This is higher than the price-to-book ratio of 5.05, which is where the S&P was trading in 1999 just before the dot-com crash.

So again, caution is the name of the game.

Not only that, but in 2004, 19% of the market’s valuation came from the tech sector.

But as of 2024, that percentage has ballooned up to 46% (and it’s most likely even higher now that the Ai craze has pushed some stocks to lofty levels).

So, once again, caution is the name of the game.

And if that weren’t enough….

For the first time ever, the amount of margin borrowing to bet on stocks has surpassed $1 trillion.

If this starts to unwind, it could trigger a shockwave – which could quickly turn into a tsunami – as investors are forced to sell their stocks to satisfy their margin debts.

Add it all up, and that’s why Karim and I are pounding the table about the significance of this upcoming Fed decision on September 17th.

![]()

YOUR ACTION PLAN

Based on all of the critical market events colliding at once, the upcoming Fed decision on the 17th could act as the trigger catalyst that sets in motion a series of events that could have enormous market consequences.

Either prepare now, or run the risk of getting punched in the teeth.

Join Karim and I on Wednesday, September 17 to get the full rundown – LIVE and FOR FREE!