Indian pulse growers face a double whammy. One, the yield and quality of crops such as moong (green gram) and urad (black matpe) are likely to be affected due to excess rain. Two, prices of pulses in the global market are in the grips of bears despite weather playing truant with Indian pulse crops.

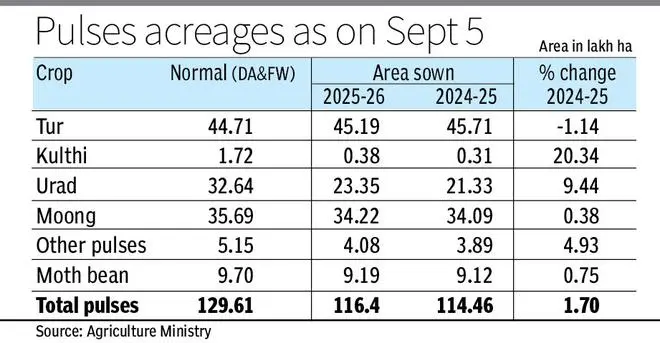

Despite farmers expanding the kharif area under pulses crops marginally, the output will likely be lower than last season, according to a cross-section of the trade and growers. This is because the excess rain has impacted the yield and quality substantially.

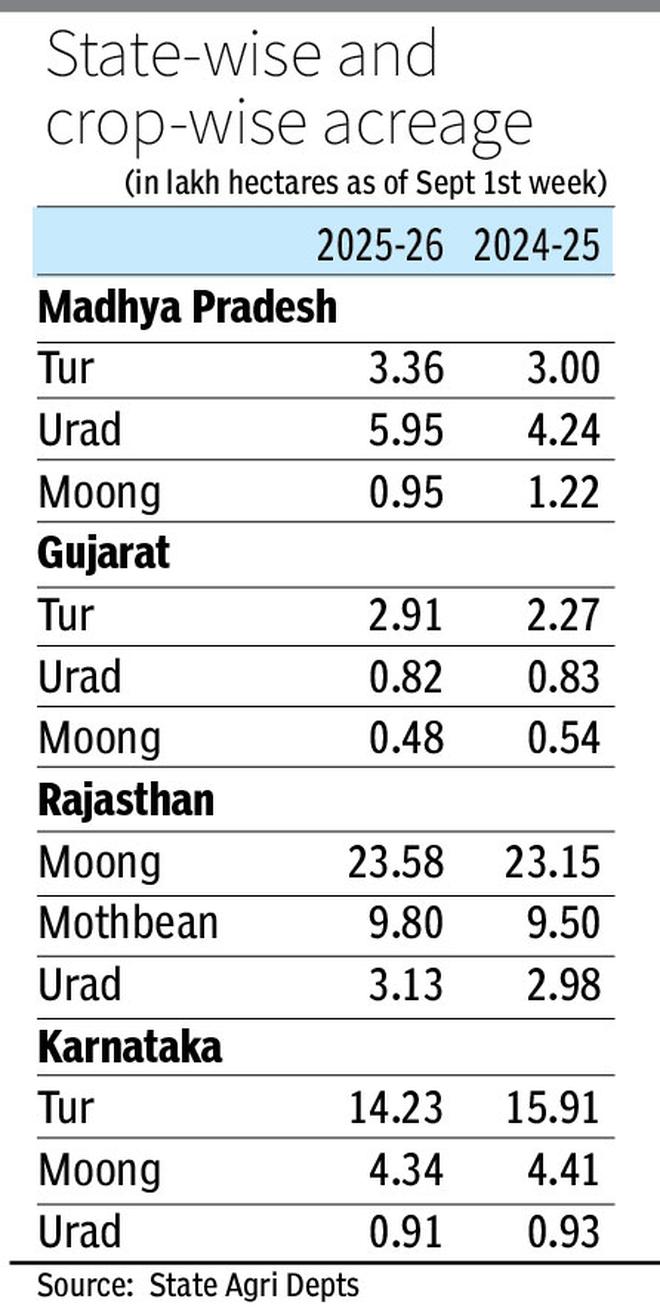

Excess rain during July-September has become a key concern for kharif crops, in general. and pulses are no exception, as the crops have been impacted across key growing states such as Karnataka, Maharashtra, Madhya Pradesh, Gujarat and Rajasthan.

“The overall kharif pulses output will be lower this year than last year as excess rains have damaged the crop across all producing States,” said Satish Upadhyay, Hon Secretary, India Pulses and Grains Association (IPGA). “It is still raining in several States, and predictions are for rain to continue over the next few days. We are still watching, but one thing is sure that the crop quality and the crop size will be less than last year.” he said.

30-50% damage

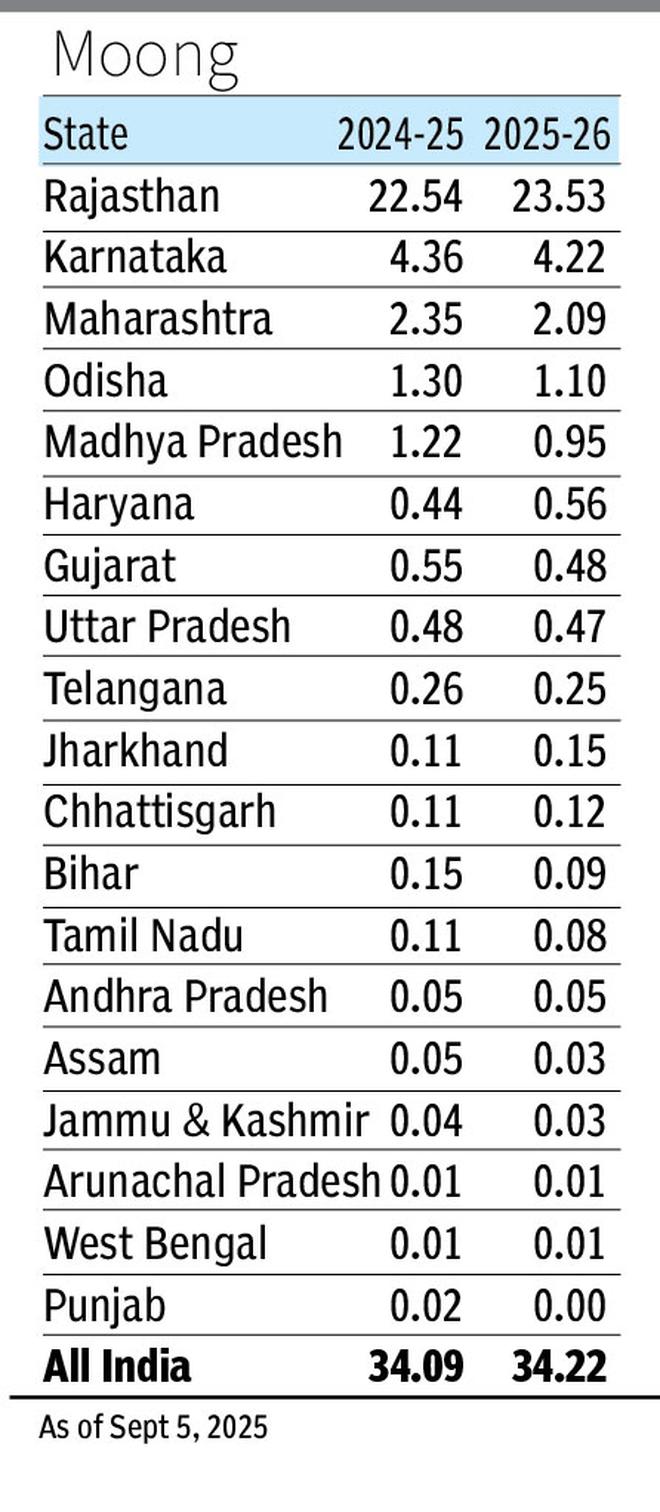

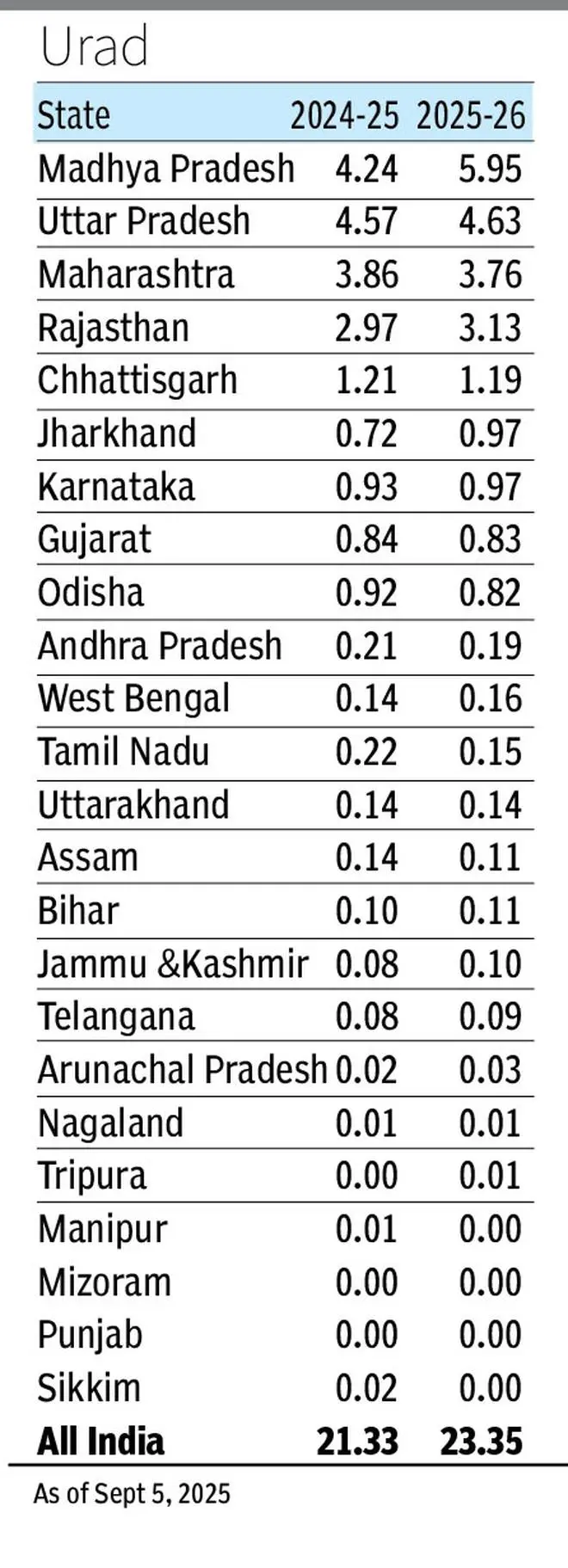

Rain has affected the harvest of urad and moong in states like Karnataka, Maharashtra and Madhya Pradesh. “The quantity will be somewhat less compared to last year, and the quality has also been impacted. Urad, moong crop with damages ranging from 30-50 per cent is coming in to the market. Even in Rajasthan the situation of moong and urad crop is grim,” Upadhyay said.

Growers of pulses face an uphill task as prospects aren’t bright after harvest, with major growers such as Canada, Australia, Africa and Russia reporting good crops. However, prices of urad witnessed an uptrend this week.

Lentil prices are ruling low because for the 2025-26 season, Canada’s production is forecast at 3.2 million tonnes (mt) due to higher area. Lentil production is forecast to increase to 2.45 mt in the North American nation, with supply higher due to high carryover stocks. Of this, red lentil production is expected to be around 1.4–1.45 mt, and that of green lentil at 1.15–1.2 mt, about 60 per cent higher than in 2024-25. In Australia, lentil production is estimated at a record 1.71 mt, while chickpea output is seen as the second biggest at 2.10 mt. Field pea production is projected at 220,000 tonnes.

Villain of bearish trend

Myanmar is quoting superior quality black matpe at $880 a tonne for October, while Brazil’s produce is ruling at $900. Prices are up three per cent this week. Desi chickpeas are offered to India from Australia at $545 a tonne (Oct-Nov delivery), while Canada is offering green lentils at $610 a tonne (Oct-Nov), compared with Russia’s $695 offer (Oct). Malawi, Tanzania and Mozambique are offering pigeon peas at $500, $515 and $530 a tonne, respectively. Tanzania and Mozammbique raised prices this week by $10-15. Canada and Russia are offering yellow peas at $330 and $350, respectively, to India, while Canada is offering red lentils to India at $550 and Australia at $540 (Oct-Nov).

Canada has cut prices of green lentils, which are used as a substitute for arhar (pigeon peas), by about 20 per cent in the past month. They are lower than Russian offers. All these are seen as signs that are not encouraging for growers.

While the key kharif pulses crop – tur (pigeon pea) is still in vegetative and flowering stages, in some States, the crop has been affected in low lying areas due to excess rain. “We are not worried about tur, but about moong and urad as damages are more. Quantity-wise moong crop may be 10-20 per cent less, but quality-wise the decline would be around 30-40 per cent. Similarly in urad, quantity-wise the crop size may be down by 10-20 per cent, but quality-wise the loss is around 50 per cent.” Upadhyay said.

“In case of tur we are sitting on a comfortable position. Even if there is a small crop loss, we have huge buffer stock and imports are still on,” Upadhyay said.

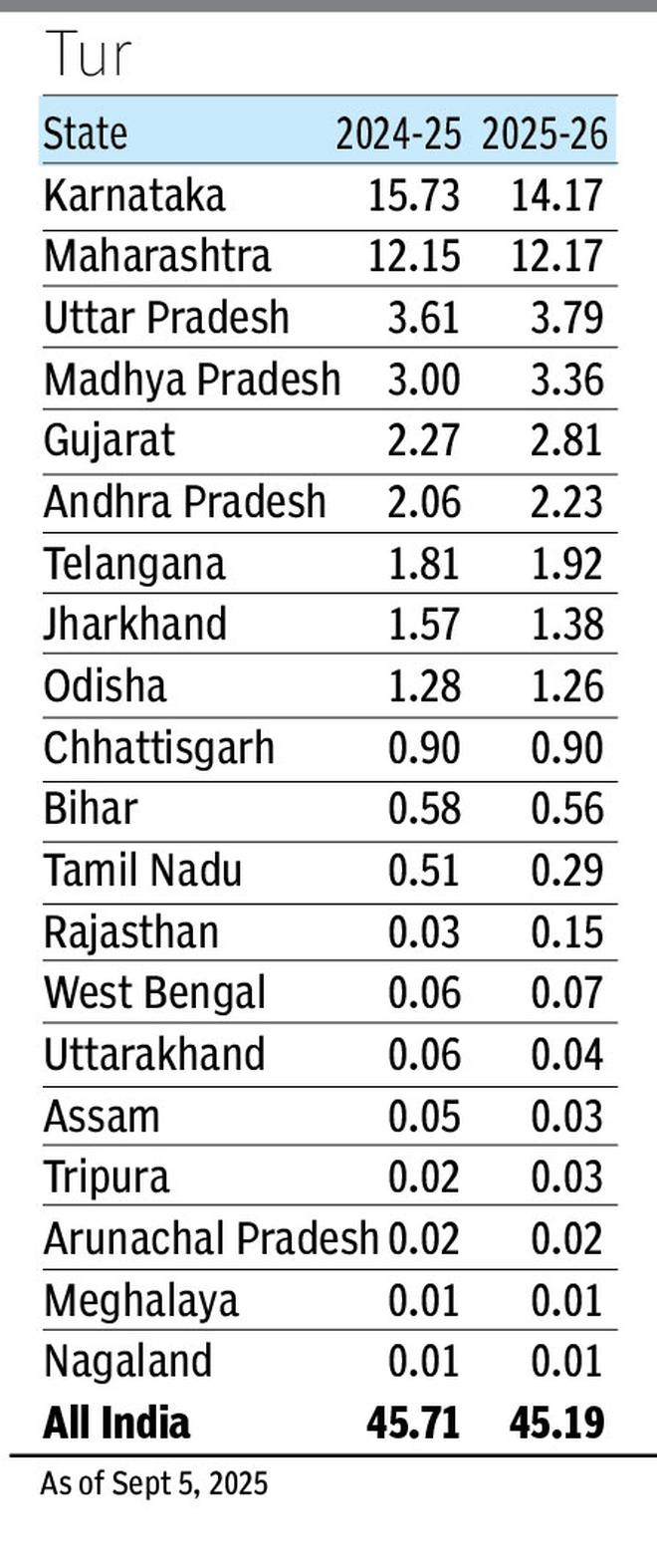

As per the third advance estimates, total pulses output during kharif 2024 was 74.95 lakh tonnes. This comprised tur output of 35.61 lakh tonnes, moong production of 17.47 lakh tonnes and urad output of 13.02 lakh tonnes. Due to the shortfall in domestic supplies, the Government allowed duty-free imports of urad and tur till March 31, 2026. India, which made record imports of pulses during the 2024-25 financial year continues to buy overseas pulses from Myanmar, Africa, Canada, Russia and Brazil.

‘Complete wash out’

Rahul Chauhan of IGrain India estimates the tur production during kharif 2025 to be less than 30 lakh tonnes due to a dip in area and crop losses in Karnataka and Maharashtra. Moong production is likely to be around 17 lakh tonnes, while urad output will be lower at around 12 lakh tonnes, as excess rain in the Bundelkhand region that spans across MP and UP has impacted the crop severely.

States that have received excess August rain include Rajasthan, Uttar Pradesh, Andra Pradesh and Karnataka. According to CRISIL, more than 10 per cent of the moong and urad crop has been affected in Rajasthan, UP and Andhra Pradesh. In Bundelkhand region, the green gram and black gram crop has faced severe damage. In Rajasthan, growers will likely face significant losses due to the flower drop and poor pod setting.

Basavaraj Ingin, President of Karnataka Pradesh Redgram Growers Association in Kalaburgi district of Karnataka, said the rain has affected crops such as moong, urad and tur. “It has been a complete washout for moong and urad as farmers could not harvest the crops,” he said. Even tur crop has been badly damaged due to excess rains and water logging, Ingin added. “It is still raining and the rain forecast is there for few more days,” he said.

Destructive spell

Farmers in Maharashtra have completed sowing of tur on over 12.23 lakh hectares as of September 11 — more than doubling last year’s coverage. Moong, however, has lagged, with sowing reaching only about 70 per cent of last year’s area. Urad has performed better, crossing its average acreage with cultivation on 3.77 lakh hectares, or 97 per cent of the State’s urad area. Overall, sowing of pulses in the State has touched 97 per cent of the season’s target.

Maharashtra agriculture officials said while pulse acreage and output have steadily expanded in recent years, productivity gains have been modest for some crops. The season also suffered a setback in mid-August when heavy rainfall led to waterlogging damaging roots, particularly in moong and urad. The spell between August 15 and 20 proved the most destructive, the Agriculture Minister said. In all, 191 talukas reported crop losses across 654 revenue circles, with 12 districts each recording damage on more than 10,000 hectares of kharif crops.

During Kharif season 2025, there has been a 14.5 per cent rise in area under pulses in Gujarat, most of which can be attributed to the growth in acreage of tur. This year, pulses have been sown on over 4.41 lakh hectares, which is 14.5 per cent more than 3.85 lakh hectares in the last kharif season. The area under tur has increased 28 per cent to 2.91 lakh hectares, while the area under moong (48.293 hectares) and urad (82,997 hectares) saw a decline of 12 per cent and 0.8 per cent, respectively, compared to the previous season.

Worry over prices

Gujarat government officials said that the heavy rain in North Gujarat this month has adversely impacted the tur, moong and urad crops sown in Kutch and Patan districts of the state. The government is yet to officially publish data regarding any crop loss that may happened due to heavy rains in various parts of the state.

The area under pulses in the kharif season has seen a decline in Telangana. As against the normal area of 3.20 lakh hectares (lh) under pulses, the State registered an area of 2.34 lh. Tur has taken the bulk of the impact, with the area falling to 1.99 lh as against the normal area of 2.71 lh. While greengram area fell to 24,000 hectares (against a normal area of 35,000 hectares), urad area fell to 10,125 hecares from 13,325 hectares.

(With Inputs from Subramani Ra Mancombu in Chennai, Radheshyam Jadhav in Pune, Avinash Nair in Ahmedabad, K V Kurmanath in Hyderabad)

This is the third report as part of businessline’s khairf outlook series

Published on September 12, 2025